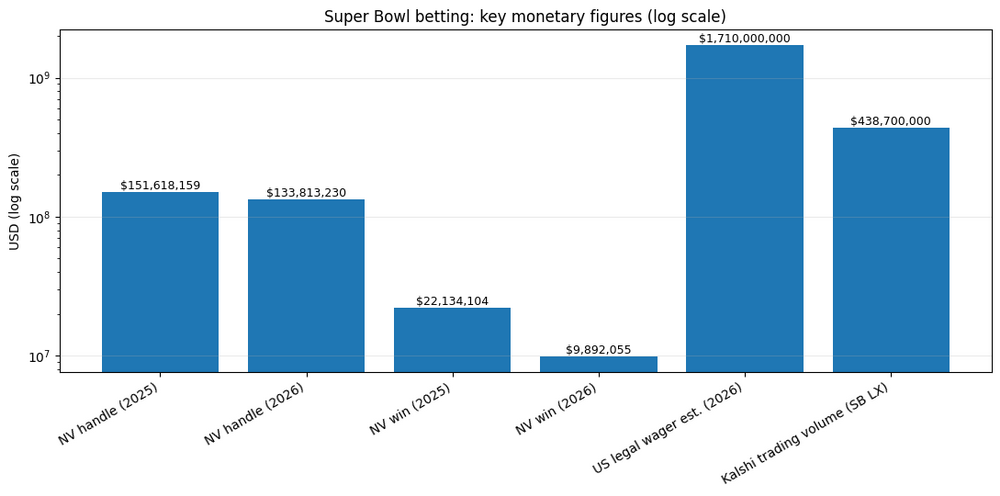

Louisiana is one Senate vote away from reshaping its sports betting landscape. Senate Bill 639, authored by Republican Senator Rick Edmonds, proposes raising the tax on online sports wagers from 15% to 21.5%. The goal? To redirect more gambling revenue toward state-funded programs without raising income or sales taxes.

The bill outlines the creation of the SPORT Fund (Supporting Programs, Opportunities, Resources, and Teams), which would allocate a portion of the increased revenue to NCAA Division I college athletics at Louisiana’s public universities. Additionally, funding would go toward early childhood education, addiction recovery services, and support for local governments.

Edmonds (pictured) and co-sponsor Senator Cameron Henry argue that this adjustment could generate millions in additional funds annually, with the LSU system among the potential beneficiaries. While some critics warn the tax hike could deter operators and reduce consumer engagement, proponents emphasize the growing profitability of sports betting and its potential to support essential services.

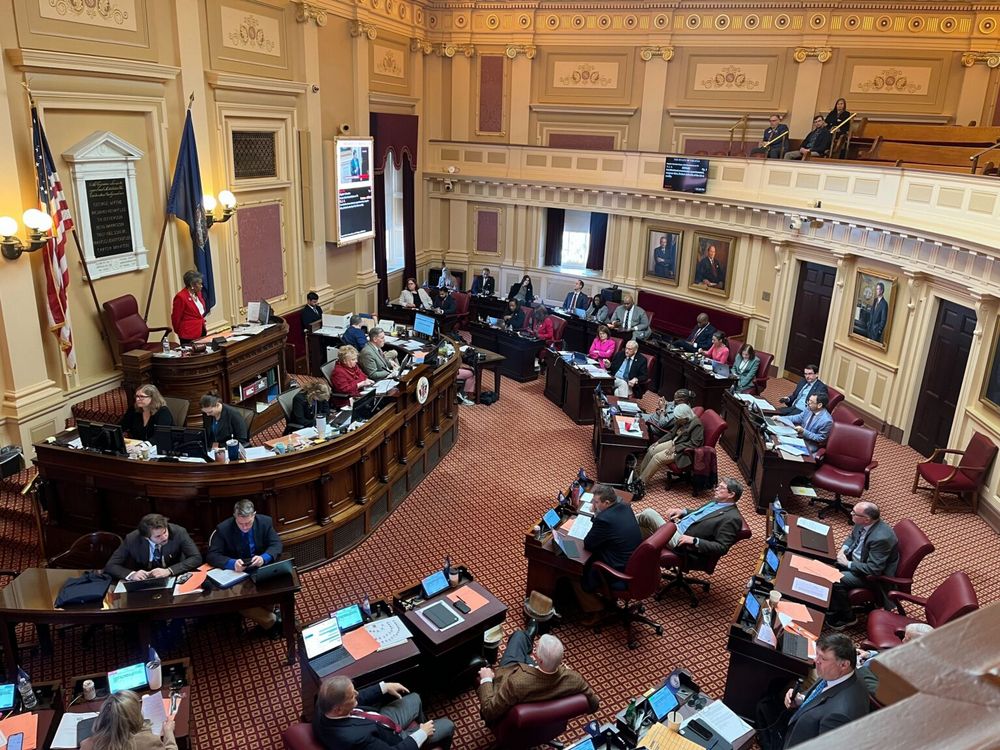

The bill passed the House with strong support and is now pending final Senate approval, expected later this week. If signed into law, the measure would go into effect in 2026, potentially setting a precedent for similar legislation across the U.S.