A simmering carriage dispute between YouTube TV and Fox could shake up not only how fans watch college football—but how tech giants position themselves in the lucrative sports betting market.

The conflict comes at an awkward time: contracts are set to expire on August 27, and Fox is pressing for steep fee hikes, while YouTube accuses the media giant of overplaying its hand. If talks fall through, viewers could lose access to Fox Sports and the Big Ten Network, jeopardizing broadcasts of marquee matchups like Texas vs. Ohio State

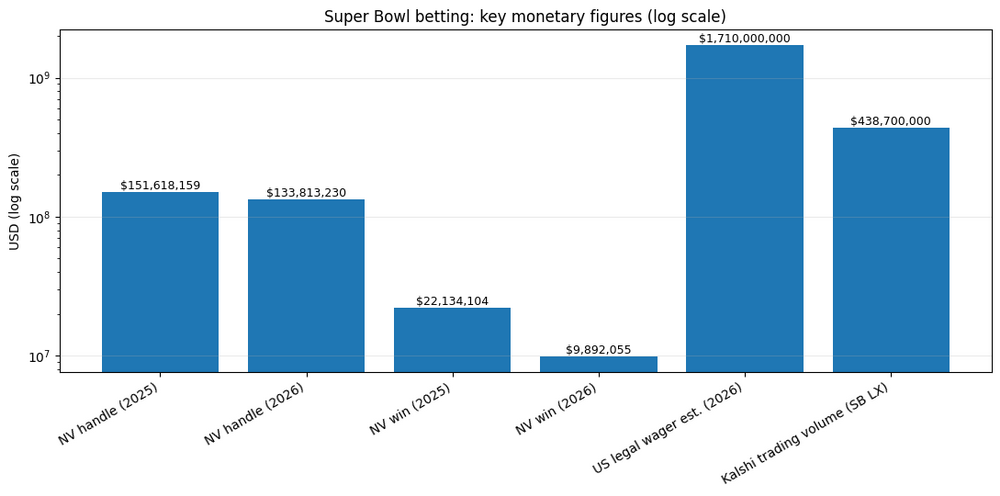

This dispute highlights how Google (which owns YouTube) and Fox are both angling for muscle in college football’s future—not just in broadcasts, but in betting too. With regulations around prediction markets already drawing scrutiny (particularly from the NCAA), the outcome could reshape how technology platforms monetize sports through betting.

YouTube TV has promised subscribers a $10 credit if Fox content vanishes. Meanwhile, Fox is ramping up its direct-to-consumer service, Fox One, playing a dual strategy to retain access and control distribution.

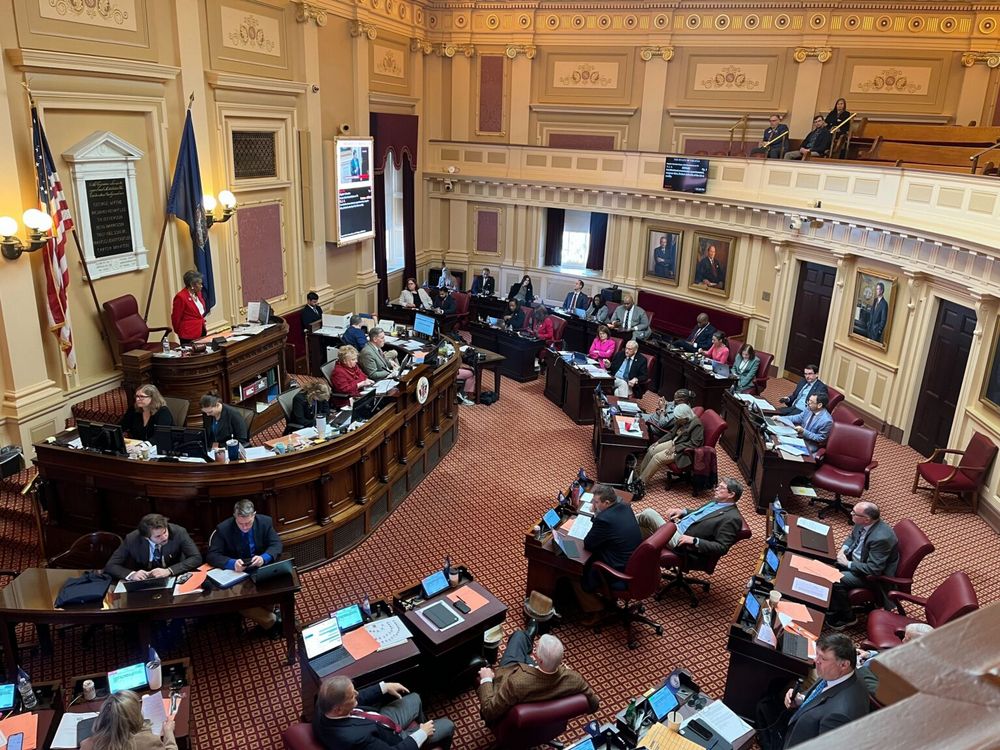

NCAA raises red flag over college football prediction markets

For betting firms and league officials, this isn't just a content fight—it’s a strategic moment. Which partner holds more power at the betting table? Right now, both Google and Fox are jockeying for positioning, hoping the fallout from cord-cutting gives them an edge in college football’s rapidly evolving betting ecosystem.