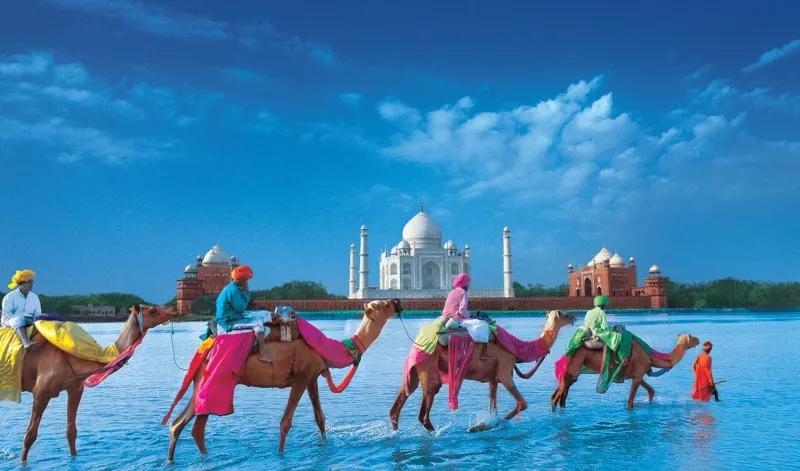

India has always been the great paradox of online gaming: a market of 1.4 billion people, tens of millions of mobile gamers, explosive year-on-year growth — and yet built on a regulatory foundation that resembled shifting sand more than solid ground. The events of 2025 made that painfully clear. When the Indian government passed the Promotion and Regulation of Online Gaming Act, 2025, effectively banning real-money skill-based games, global operators discovered what it means to build empires atop a grey zone.

The most visible casualty was Flutter Entertainment, which recorded a US $556 million impairment tied directly to the shutdown of its Indian operations through its subsidiary Junglee. For years, companies argued that rummy, fantasy sports, or certain skill-based formats fell outside gambling definitions. Courts oscillated, regulators hesitated, and operators thrived — some reporting double-digit growth in Gross Gaming Revenue while investing heavily in user acquisition. But when the axe fell, it fell hard. Flutter’s APAC revenue dropped 12% year-on-year, and India — once viewed as its next frontier — was reclassified as a high-risk market overnight.

The truth is that India’s gaming “boom” was always a legal tightrope. Operators leaned on state-by-state distinctions, court precedents, and the absence of unified national rules to justify expansion. Investors, encouraged by projections of India becoming a US $5–7 billion online gaming market by the end of the decade, poured capital into what they believed was inevitable growth. But inevitability is a dangerous assumption in jurisdictions where political, cultural, and economic pressures collide.

And then there is Australia — another market that reminded operators of the volatility hiding beneath headline growth. Flutter’s Q3 results showed that even where gaming is legal, outcomes are never guaranteed; a 110 basis-point negative margin swing in sports betting due to unfavourable results reinforced that regulatory stability is only part of the equation. Market performance remains at the mercy of unpredictability.

India’s sudden crackdown sends a clear message to the global industry: grey zones are not growth strategies — they are time bombs. Operators who rely on ambiguity as a business model expose themselves to abrupt bans, asset write-downs, and investor backlash. For global gaming companies, sustainable expansion must rest on regulatory certainty, not regulatory hope.

The Indian case will be studied for years, not merely as a policy shift, but as a strategic warning. In gaming, the size of the market means little if the ground beneath it can disappear overnight.