The Labour government’s looming shake-up of UK gambling taxes has pushed machine gaming duty (MGD) from a technical footnote into a very real threat for pubs and high-street venues. At the centre of the storm sits JD Wetherspoon, where slots and fruit machines have quietly become one of the few bright spots in a squeezed hospitality sector.

According to the group’s latest figures, Wetherspoons generated £73.2m from gaming machines in the year to July 2025, up more than 11% year-on-year, compared with roughly 4% overall sales growth. Gaming now accounts for around 3–4% of the chain’s £2.13bn revenue, but crucially, it is high-margin income that helps offset rising labour, energy and food costs.

That cushion is now in jeopardy. The Institute for Public Policy Research (IPPR) has proposed lifting MGD on slots and gaming machines from 20% to 50%, as part of a broader package to raise about £3bn a year by targeting high-yield gambling products. Former Prime Minister Gordon Brown has backed the plan, arguing that tougher gambling taxes could help fund the removal of the two-child benefit cap and tackle child poverty.

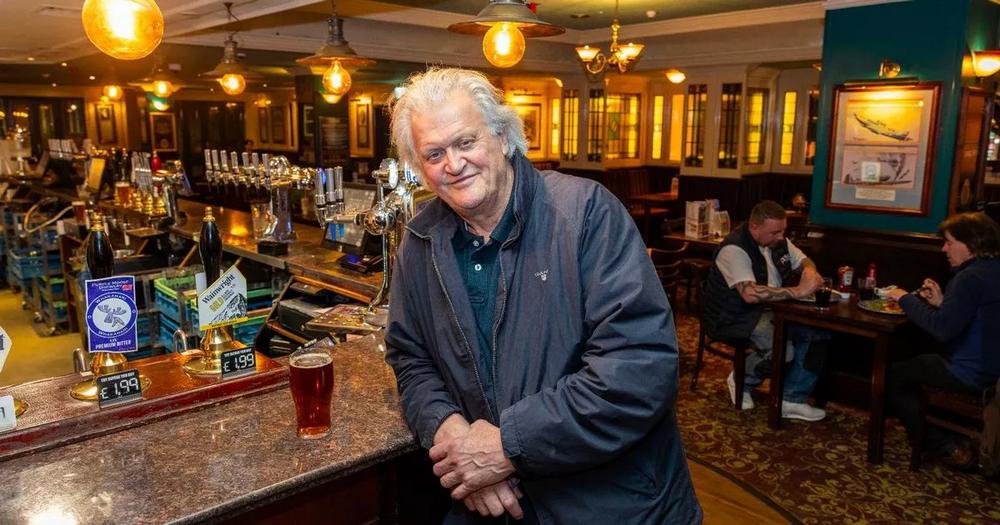

For Wetherspoons’ slots, the numbers are stark. Using IPPR’s assumptions, The Times estimates that the pub chain’s gaming duty bill would jump from roughly £27.5m to £45.7m, slashing total post-tax profits by around 48% on current performance. Founder Sir Tim Martin has warned that such a move would pile pressure on a sector that already pays hundreds of millions in tax and relies on low-stake machines – £1 max bet, £100 top win – as “incidental” but vital revenue.

Industry groups share that concern. The Betting and Gaming Council cites EY modelling suggesting that pushing duties on slots towards 50% could cut gambling’s gross value added by up to £3bn, cost tens of thousands of jobs and drive stakes into offshore and unregulated markets.

For now, Chancellor Rachel Reeves is under simultaneous pressure from MPs to “tax the most harmful gambling products” and from UK hospitality to avoid turning a fragile recovery into another crisis. Whatever figure appears in the Budget, one thing is clear: Wetherspoons’ slots are no longer just pub entertainment – they’re a battleground for how far the state should lean on gambling to plug its fiscal gap.