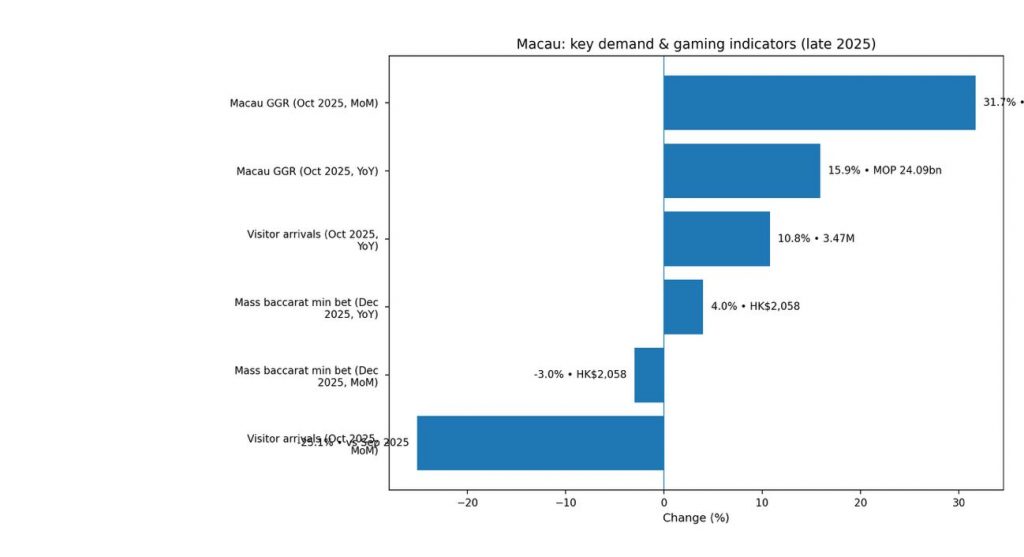

Macau’s casino operators are adjusting table pricing and market strategy as the city’s long-running satellite casino era comes to an end, driving intensified competition for players and revenue share. Citigroup data shows that mass-market baccarat minimum bets have softened since October 2025, reflecting how operators are fighting to capture business previously served by satellite venues.

According to Citigroup analysts, the average minimum bet across Macau’s mass baccarat tables was about HK$2,058 in December, a figure that—while still modestly higher than a year earlier—was down roughly 3% month-on-month. This suggests concessionaires are deploying price sensitivity as a tool to attract players displaced by closures of satellite casinos. Some newly opened gaming areas feature minimum bets as low as HK$300, indicating a clear tactical shift.

The backdrop to this pricing shift is the winding down of Macau’s satellite casino model under the amended Gaming Law. The city has entered the final phase of this transition, with a series of satellite venues—including Kam Pek Paradise, Ponte 16 and Casino Fortuna—closing or being absorbed into core concessionaire operations ahead of the end-of-2025 deadline.

Integrated resorts such as StarWorld, City of Dreams, Wynn Macau and Casino Lisboa are among the operators opening new or expanded mass-gaming areas to capture players who once frequented satellite venues, particularly in downtown Macau. Analysts note these areas were “quite crowded” during recent surveys, suggesting early success in reclaiming fragmented mass-market demand.

At the same time, premium mass play remains a strong segment, with year-on-year participation and bet sizes growing, underscoring a diversified demand profile even as the market restructures.

For international gaming executives and investors, the signals are clear: route-to-player strategies are evolving alongside regulatory change, and dynamic pricing—especially at mass-market baccarat tables—has become a frontline tool in the competition for share in Macau’s post-satellite landscape.