With the new bill presented by the team of the recently inaugurated President, Gustavo Petro, several tax changes are proposed through a "Tax Reform for Equality and Social Justice", where 2 points are highlighted that are especially directed to the gambling industry.

As first point, the general income tax rate applicable to national corporations and/or legal entities with or without residence in the country, obliged to file the annual income and complementary tax return, would be thirty five percent (35%).

In addition, Coljuegos would have to pay a 9% rate on the income obtained. This would apply to those companies in which the participation of the State is higher than 90% that exercise the monopolies of luck and chance and liquor and alcohol.

On the other hand, for individuals, it is proposed to eliminate from the non-taxable occasional gains the profits from the sale of shares of a company listed in the Colombian Stock Exchange, when such sale does not represent more than 10%

And the exempt income from prizes for horse or dog betting and contests, together with lotteries and games of chance, corresponding to an exemption currently in force of 410 UVT and 48 UVT, respectively.

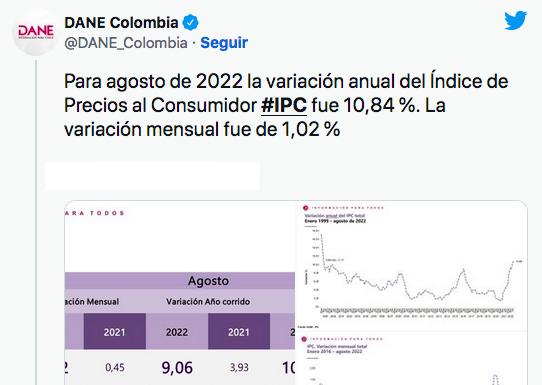

The Dian fixed the value of the tax value unit (UVT), which will be in force as from January 1, 2022, at $ 38,004 COP (8,64 USD).

Finally, according to the arguments presented in the bill, recognizing that the occasional gains from raffles, lotteries and similar do not constitute a recurrent source of income nor guarantee a vital minimum for those who receive them.

Therefore, the differential treatments are considered unjustified from a social point of view, even more so when unifying the taxable net income from the different sources of income, including occasional gains, there is a bracket of 1,090 UVT with a 0% rate.