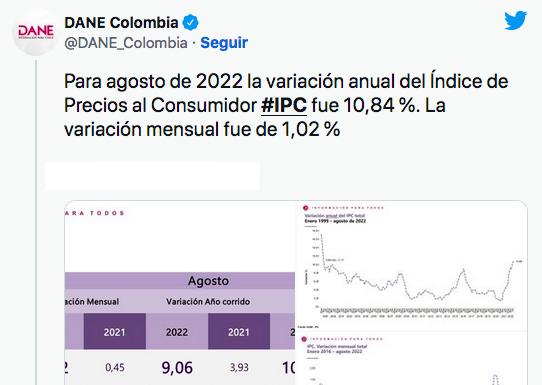

The Dane ( statistics Colombian body) announced, that the annual variation of inflation in August was 10.84%, while for the reference month it was 1.02%. For its part, the variation for the year to date (January - August) was 9.06%.

According to the report, the annual variation of the CPI (10.84%) was 6.40 percentage points higher than that reported in the same period of the previous year, when it was 4.44%. In addition, the figure also exceeded the annual variation to July, when the CPI stood at 10.21%.

Usury rate does not stop rising

In the last year, the Banco de la República has raised the monetary policy rate by 7.25 percentage points (725 basis points) while in the same period of time the usury rate has risen 9.46 percentage points (946 basis points). ).

The financial institution certified that the annual effective Current Bank Interest for the microcredit modality is 39.47%, which represents an increase of 150 basic points (1.50 percentage points) in relation to the previous certification (37.97%).

For the consumer and ordinary credit modality, it stands at 31.92% annual effective, a result that represents an increase of 132 basic points (1.32 percentage points) with respect to the previous period.

For the microcredit modality, it is 59.21% effective annually, an increase of 225 basic points (2.25 percentage points) compared to the previous period.

The usury indicator rises in line, in general, with the rate increases of the Banco de la República and the financial entities bring their credit products close to that limit to compensate for the greater risk of non-payment