Four out of Macau’s six casino concessionaires “have expressed interest in investing in Thailand” against the backdrop of that country’s mulling of casino legalisation, says a Monday report from brokerage CLSA Ltd.

Investment advisor CLSA Ltd. thinks the annual gross gaming revenue (GGR) value of a Thai casino industry – mostly driven by foreign players – could be US$8.5 billion, up to as much as US$30.8 billion, though CLSA says its “base case is US$15.1 billion”.

“Among Macau gaming concessionaires, we believe Galaxy [Entertainment Group Ltd], Las Vegas Sands [Corp], MGM Resorts [International] and Wynn Resorts [Ltd] have expressed interest in investing in Thailand,” stated the report, referring to the parent groups of Macau licensees.

Thailand Casinos Inch Closer to Reality, Could Open before MGM Osaka.

“In contrast, Melco [Resorts & Entertainment Ltd] and SJM [Holdings Ltd] are less likely to show interest given their balance sheet constraints,” added Hong Kong-based CLSA analysts Jeffrey Kiang and Leo Pan; along with their colleague Naphat Chantaraserekul, head of Thailand research.

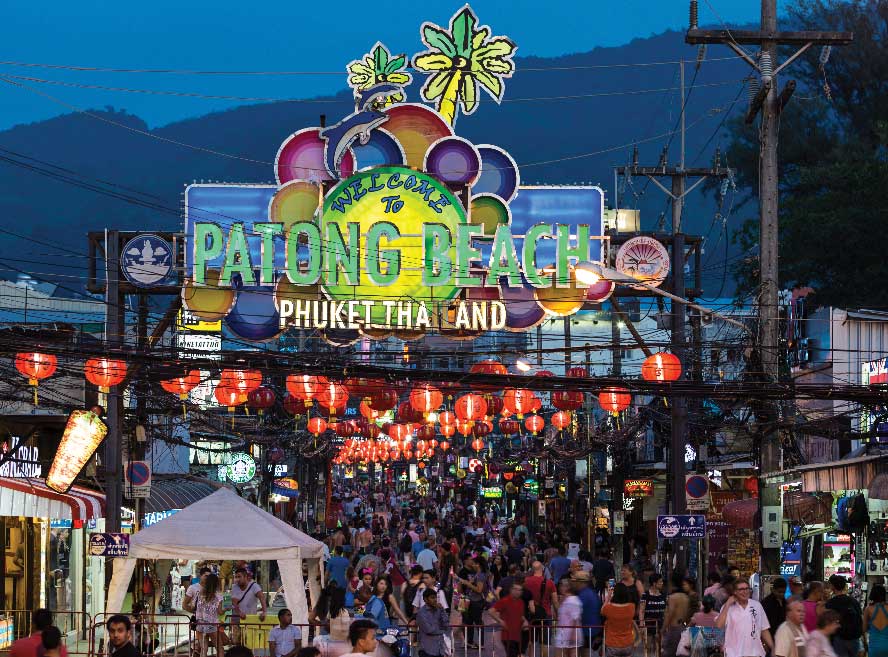

According to industry observers, five possible locations had so far been mentioned for such resorts. Two were in the capital, Bangkok and there had been mention of one each in: the country’s Eastern Economic Corridor; Chiang Mai; and Phuket.

Singapore is home to just two integrated resorts, which are operated by Genting Singapore and a unit of Las Vegas Sands (NYSE: LVS).

It’s expected that Thai entertainment complexes featuring casinos could boost tourism spending in the country by as much as 52% annually. That’s one reason why the country will likely draw bids from some of the biggest names in the gaming industry.