Congressmen refuse to discuss this new tax and the Government's time is running out as the legislative period ends on December 20. The tax reform is dying. There is still no agreement between the Government and the speakers of this Government project in front of the presentation to begin the discussion of the first debate in the joint sessions and the bone of contention is the tax on gambling platforms.

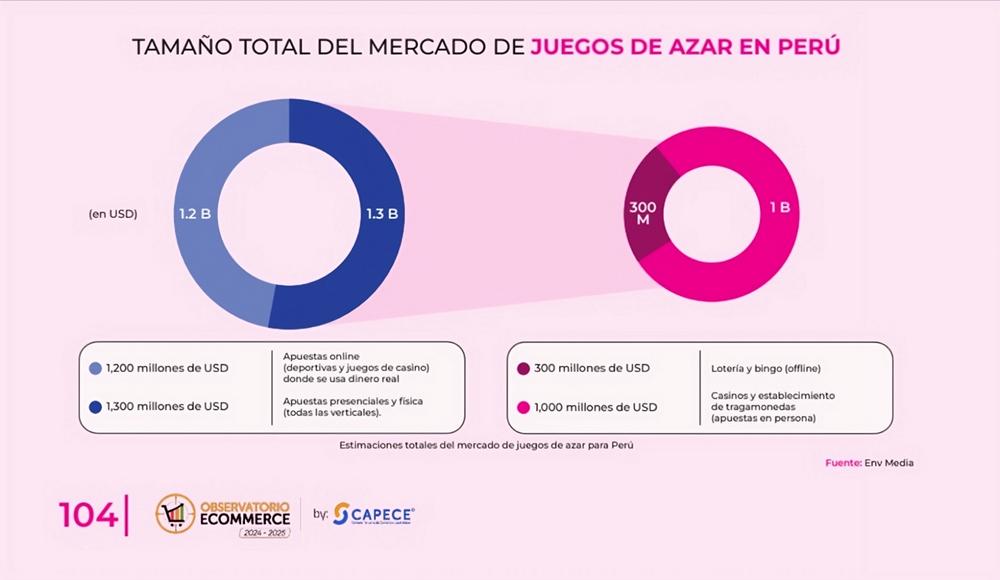

The Government insists that the application of this tax can be gradual but some political sectors, not to say all the representatives to the House except those of the Historical Pact, refuse to discuss the issue. Main changes in Petro's second tax reform Among the main changes, the elimination of VAT on online gambling and betting platforms stands out, a tax that sought to collect $2 billion in its first year and that had been promoted by the former Minister of Finance, Ricardo Bonilla.

That is, the proposal to apply a 19% VAT to this sector has been eliminated due to uncertainty about its impact and the possibility that it would encourage illegal betting

Articles 7, 8 and 9, which taxed the sale of assets by companies and natural persons, and article 25, which sought to impose VAT on hybrid vehicles, were also withdrawn. Likewise, the reform initially proposed lowering the taxable base of the wealth tax, which would have affected more people.

However, after the debates and the concern of the congressmen, it was decided to maintain the taxable base at 72,000 UVT (approximately usd $1`000,000. oo). But the wealth tax rates will be adjusted so that taxpayers with assets between 72,000 and 122,000 UVT will maintain the current rate of 0.5%.

The Government is still hoping to reach an agreement with them to file the motion, however, time is against the Government because the legislative period ends on December 20 and without this discussion the Government will have to cut the 2025 budget by at least 12 billion pesos.