A new market-research highlights how a tightly controlled licensing model can still produce outsized digital wagering scale. The state’s regulated online casino and sports betting ecosystem—authorized under Public Act 21-23 in October 2021—has accelerated quickly, reaching a new high-water mark in late 2025.

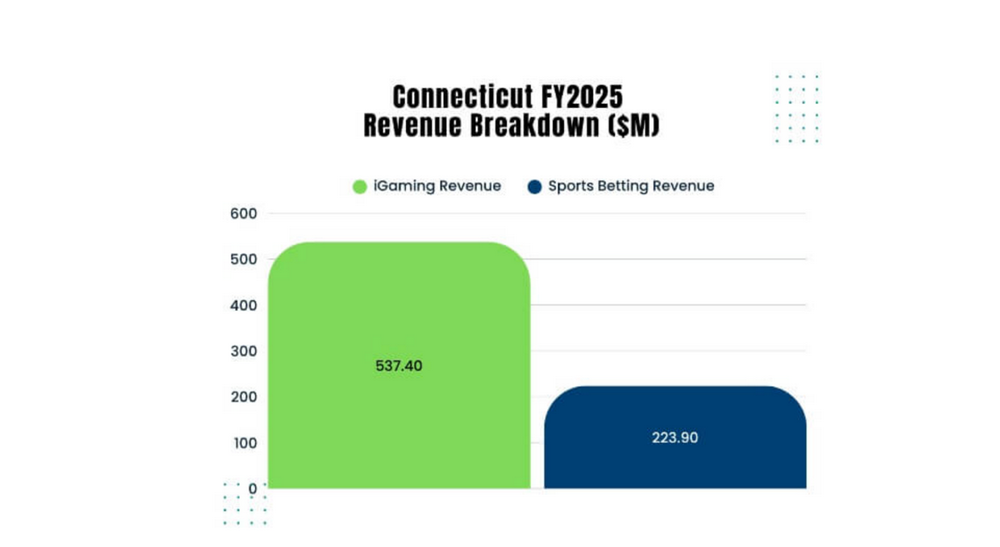

According to the report, total gaming revenue for fiscal year 2025 hit $761.3 million, a 31.3% year-over-year increase. Of that, $537.4 million came from iGaming (+32.3%) and $223.9 million from sports betting (+29.0%).

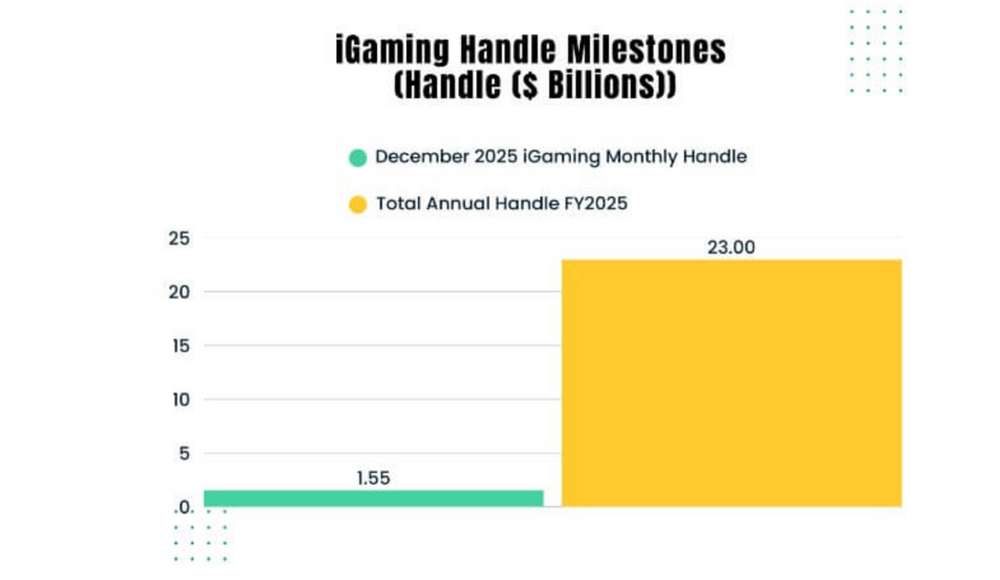

The same analysis notes a record $1.55 billion iGaming handle in December 2025, up 21% month-over-month—an indicator of sustained consumer adoption rather than a one-off spike.

The competitive map remains intentionally concentrated: tribal platforms tied to Foxwoods Resort Casino (via DraftKings) and Mohegan Sun (via FanDuel), plus Connecticut Lottery Corporation’s online offering (Play SugarHouse, operated by Rush Street Interactive). The report estimates the two tribal platforms account for roughly 90–95% of sports betting handle, with the lottery channel taking the remaining share, citing illustrative monthly splits and hold rates.

Regulatory posture is a key part of the story. The Connecticut Department of Consumer Protection notes that the online gaming and sports wagering regulations became effective February 1, 2022, anchoring compliance expectations for platform integrity, controls, and enforcement. Connecticut’s technical standards framework explicitly positions the stricter standard as controlling in any conflict, and emphasizes minimum internal control standards (MICS) and auditable system security requirements.

The brief also points to heightened scrutiny in 2025—including stricter licensure/verification processes for certain personnel and enforcement actions such as an additional $1.44 million fine tied to unlicensed activity by High 5 Games.