Las Vegas is delivering a message that matters to every gaming market watching demand signals in 2026: headcount can soften while casino win stays resilient—if the mix of customers, product performance, and event calendar holds.

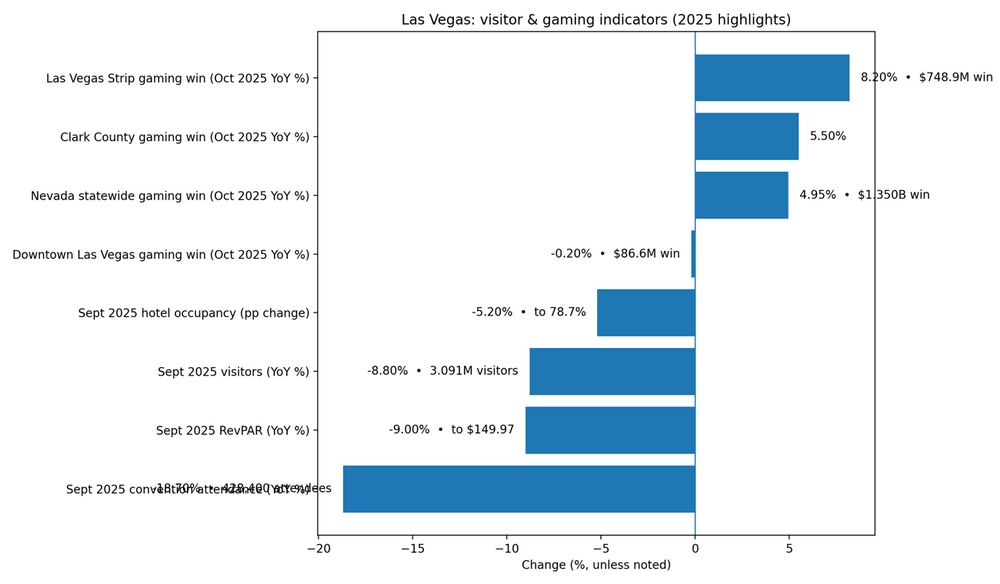

Recent reporting shows total visitation to Las Vegas is down 8.8% in 2025, yet gaming continues to show strength. In October 2025, Clark County gaming revenue rose 5.5% year over year, and year-to-date win is up 1.1% versus the same period in 2024.

The broader Nevada picture supports the same storyline. October statewide results also came in higher year over year, reinforcing that the “casino economy” can outperform pure tourism volume in the short term.

For operators, the implication is not that visitation no longer matters—it does—but that yield per visitor is becoming the decisive KPI. When discretionary budgets tighten, the market often becomes more polarized: fewer low-spend trips, more emphasis on premium experiences, and sharper conversion of entertainment traffic into gaming time. Major event dynamics also matter: convention and sports calendars can reshape weekday demand, even when monthly totals look weaker.

Internationally, Las Vegas is once again acting as a real-time laboratory: the winning formula is less about chasing raw footfall and more about optimizing the floor, tightening reinvestment, and delivering a product mix that captures higher-value play. In 2026, markets that master that transition may look “imbatible” in performance—because they are built for efficiency, not just volume.