Las Vegas / Washington – August 26, 2025. The U.S. gambling industry is facing a crisis hiding in plain sight. A new report shows the illegal gambling market has exploded to more than US$673.6 billion annually, nearly a third of the nation’s entire gambling economy. Despite record casino revenues, aggressive legalization of sports betting, and expanding online regulation, the underground market is growing faster than the legitimate one—and it’s gutting the industry from the inside out.

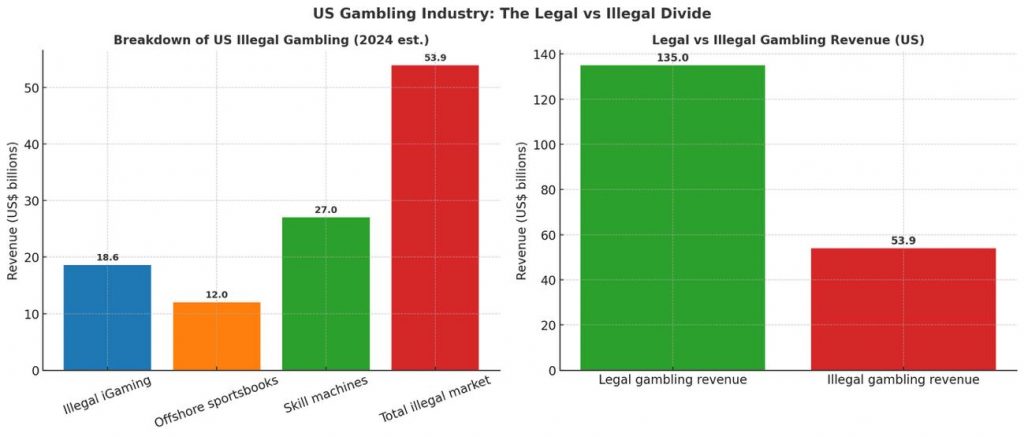

The American Gaming Association (AGA) estimates illegal operators hauled in US$53.9 billion in revenue last year, depriving states of at least US$15.3 billion in tax revenue. That’s money meant to bankroll schools, infrastructure, and public safety. Instead, it’s fueling offshore books, unlicensed “skill machines” stuffed into bars and gas stations, and shady online casinos targeting vulnerable players.

Michigan steps up illegal gambling crackdown with raids and online shutdowns

Dave Foreman, AGA’s VP of Research, didn’t mince words:

“This isn’t just leakage—it’s hemorrhaging. States are bleeding billions while criminals laugh all the way to the bank. The industry’s integrity is being undermined every single day these operators go unchecked.”

Pennsylvania Raids Illegal Gambling Network: Over 400 Machines Seized

The numbers are staggering. Illegal iGaming—unlicensed online casino-style games—raked in US$18.6 billion last year alone. Offshore sportsbooks took another US$12 billion, despite the rapid expansion of regulated sports betting across more than 35 states. And the ubiquitous gray-market “skill machines” now generate US$27 billion annually, operating outside any consumer protections.

The fragility of the system is undeniable. Regulators have celebrated the success of legal frameworks, but the black market’s growth exposes the limits of enforcement. Consumers often can’t tell the difference between legal and illegal sites, and with social media platforms flooded with slick ads from unlicensed operators, the line between regulation and chaos is blurring.

For casinos and sportsbooks playing by the rules, this isn’t just unfair competition—it’s existential. Billions in potential revenue are evaporating into the shadows, making it harder for licensed operators to invest, expand, or deliver the responsible gambling safeguards regulators demand.

The message is blunt: America’s gambling boom is standing on shaky ground. Unless state and federal authorities close enforcement gaps, coordinate across jurisdictions, and crack down on illegal advertising online, the black market will keep outpacing the regulated sector. The industry wanted growth. What it got, instead, is a shadow empire that now controls nearly a third of the action—and it’s not going away quietly.