Nevada has long been the gold standard for sports betting in America. But even as nearly two‑thirds of all sports wagers in the state occurred via mobile devices in 2023, bettors still must visit a physical casino to register their accounts—calling into question why Nevada hasn’t embraced full online enrollment like other states do.

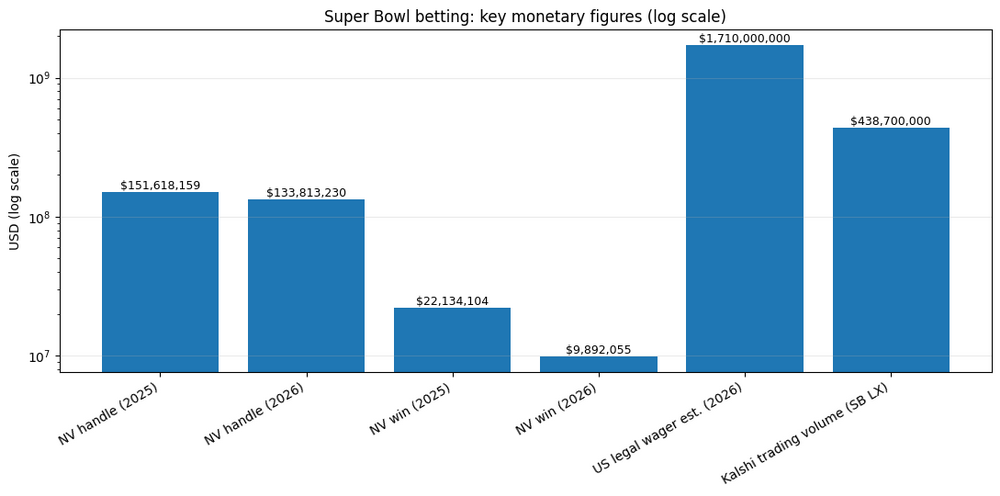

Last year, Nevada sportsbooks accepted more than $4.9 billion in online wagers—accounting for roughly 66% of total handle—even as the state slipped from the national leadership in raw betting volume. Developer-funded models in other states, particularly Arizona, processed an extra $87 million in a single month due to remote sign‑up options.

Industry voices say the requirement to register in person is “a minor annoyance” that carries real economic consequences—enough to drive spray operators like FanDuel and DraftKings to skip Nevada entirely. Chris Krafcik from Eilers & Krejcik Gaming notes that these giants are “materially additive” and could substantially boost Nevada’s market share if allowed in.

The origin of the policy is rooted in Nevada’s casino lobby, which argues that the walk-in registration requirement drives foot traffic into sportsbooks and floor amenities—restaurants, shows, leisure—which would vanish with remote sign‑ups.

Meanwhile, regulatory bodies point out that sports betting accounts for just 3% of Nevada’s overall gaming revenue, based on record‑setting $15.5 billion statewide gaming income in 2023.

Despite these arguments, expert analysis and consumer surveys indicate in-person registration is a bottleneck. A quantitative study showed 76% of bettors support remote sign-up, and a full 80% would not drive more than an hour for registration—suggesting Nevada’s model may constrain growth.

In contrast, states with 100% online onboarding saw their online handle surge past Nevada’s. For instance, New Jersey handled over $17 billion in mobile wagers, dwarfing Nevada’s $5.5 billion online intake.

With FanDuel and DraftKings absent, and major operators left on the sidelines, Nevada is ceding ground to more digitally agile markets. Industry analysts predict that allowing remote signing would not cannibalize in-casino revenues, but instead, expand the state’s digital betting tax base by hundreds of millions annually.

The message is clear: Nevada retains prestige and per-capita dominance, but its in-person policy could cost it the digital sports betting race.