New Jersey online casinos set a new record for revenue through the halfway point of the year. The industry has produced $1.39 billion through June.

The New Jersey Division of Gaming Enforcement reported that operators generated $230.7 million in revenue last month. That’s below the $246.8 million platforms record in May, which was an all-time record. Despite the June dip, New Jersey online casinos are booming, with no significant signs of slowing down.

Grading the market through June

It’s obvious that operators aren’t going to set records every month, however, the market seems to set a new bar every chance it can get. Halfway through 2025, online casinos are doing just that

The $1.39 billion in year-to-date revenue is a 22.7% increase from this time last year. Here are following cumulative totals through June in previous years:

- 2025: $1.39 billion

- 2024: $1.13 billion

- 2023: $930.8 million

- 2022: $814.5 million

- 2021: $634.2 million

Online casinos are on pace to produce $2.78 billion in 2025, which would be a whopping 44.8% increase from 2024.

Fanatics takes a hit, but reinforcements on the way

Fanatics Casino had been climbing the ladder in New Jersey. The operator recorded $6.2 million in May revenue. However, it took a significant hit in June, only registering $3.6 million in revenue. That’s a month-over-month decrease of 41.9%, and it dropped Fanatics out of the top 10.

The company announced that it is adding five new games to its portfolio that are WWE-themed. They should be available in time for SummerSlam, which takes place at MetLife Stadium on Aug. 2. The new games coming to Fanatics are:

- WWE Blackjack

- Raw Multiplier Melee

- SmackDown Big Money Entrance!

- WWE Bonus Rumble Gold Blitz

- WWE Clash of the Wilds

FanDuel widens lead

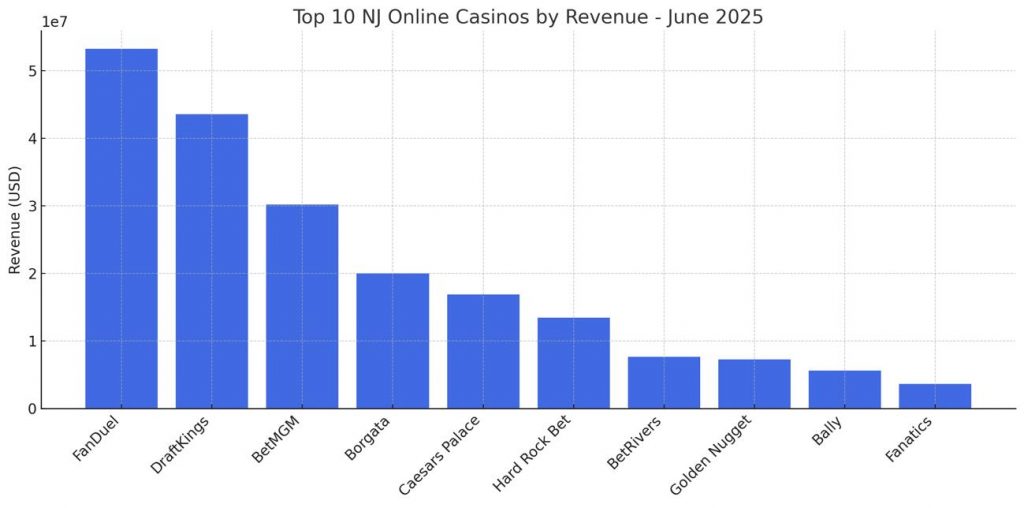

FanDuel Casino has been the top operator in the Garden State for quite some time. The company created further distance from rival DraftKings in June.

In May, FanDuel tallied $54.4 million in revenue compared to DraftKings’ $48.1 million. In June, FanDuel widened the gap by a large margin, collecting $53.3 million to DraftKings’ $43.6 million. FanDuel continues to command the market in New Jersey and doesn’t appear to be giving up its hold anytime soon.

Jackpot City leaving market

Super Group, which operates Jackpot City in New Jersey and Pennsylvania, is leaving the US sports betting market.The operator produced $2.1 million in June, which is a slight improvement over May’s total of $1.8 million. Super Group CEO Neal Menashe said he thinks resources would be better served elsewhere.

“This is a difficult decision, particularly because our US team has worked hard and made progress over recent quarters. Nonetheless, recent regulatory developments combined with ongoing assessment of capital allocation requirements have led us to believe that our stringent hurdle for return on capital will likely not be met in this market any time soon”

The market would be down to 27 operators after Jackpot City’s departure. Super Group did not provide a specific timeline of Jackpot City’s departure in the Keystone State, as it is still in the early stages of its exit strategy.