Massachusetts has seen strong tax revenue from legalized sports betting, but the wider economic impact remains minimal, according to a new report by the UMass Donahue Institute. While the state collected more than $90 million in sports wagering taxes during the first full year of operation, job creation and vendor engagement have significantly lagged.

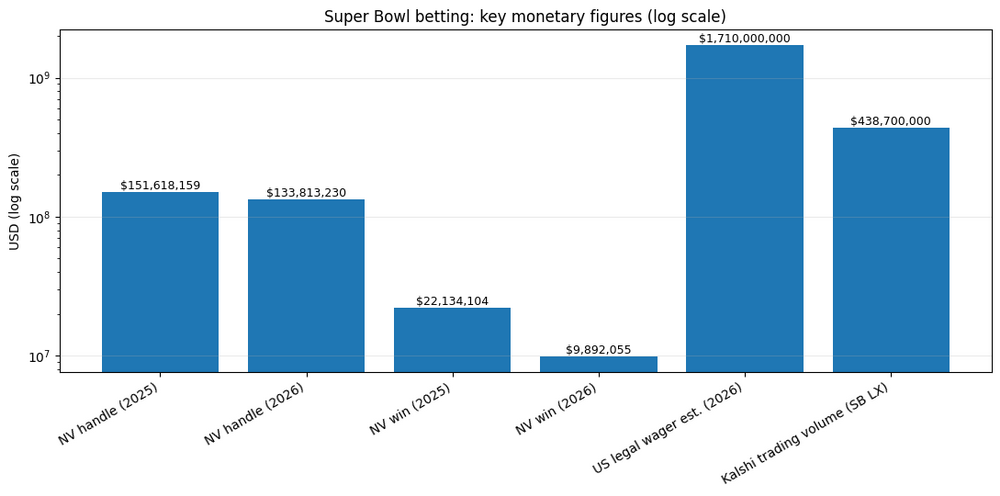

In 2023, bettors in Massachusetts placed $4.7 billion in online sports bets, with about $4.3 billion returned as payouts. The remaining revenue translated to $90.8 million in taxes for the state, making up nearly a quarter of all non-lottery gambling tax revenue. However, only 4% of vendor-related spending from sportsbook operators went to businesses based in Massachusetts. In comparison, casino operators spent nearly 46% of their vendor budgets in-state.

The employment impact was also underwhelming. The report estimates that mobile sports betting led to just 118 net new jobs, many of which were likely administrative or remote. Physical casinos, by contrast, employ thousands of people across the state, providing more direct economic benefit.

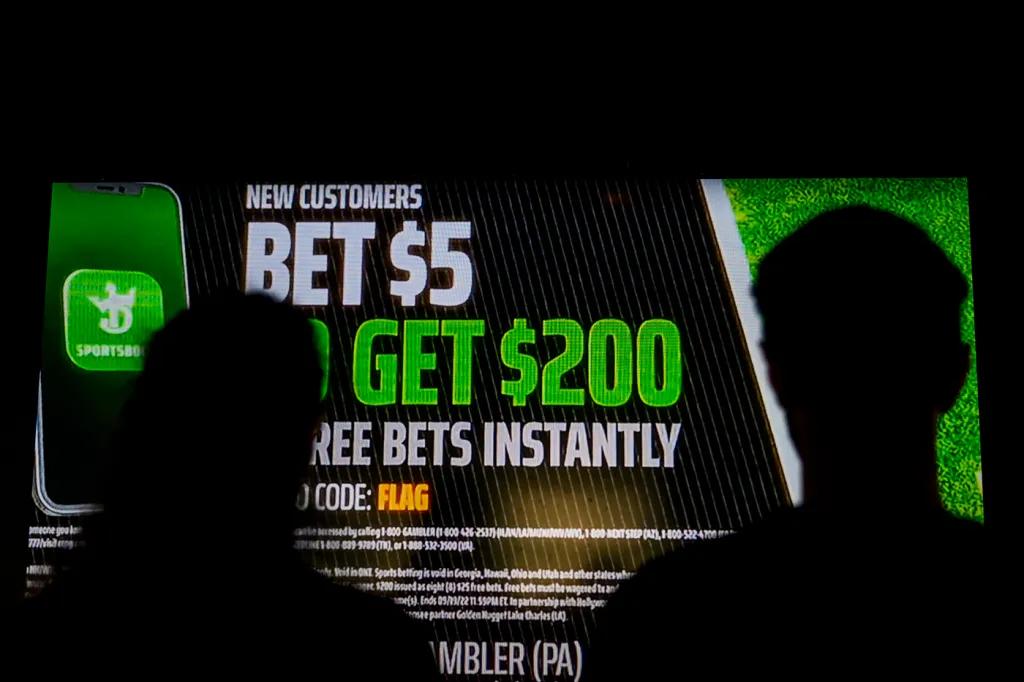

A further concern is that the bulk of betting activity does not represent new money entering the economy. Approximately 71% of the revenue generated by mobile sports betting was money reallocated from other sectors like dining, live entertainment, and local tourism. Only 29% of the spend came from new discretionary funds or out-of-state bettors.

Massachusetts taxes mobile bets at 20% and retail bets at 15%, a lower rate than that applied to casino gaming. As casino revenue growth slows and mobile betting expands, some analysts warn the state could face diminishing returns unless it recalibrates its regulatory and fiscal framework.

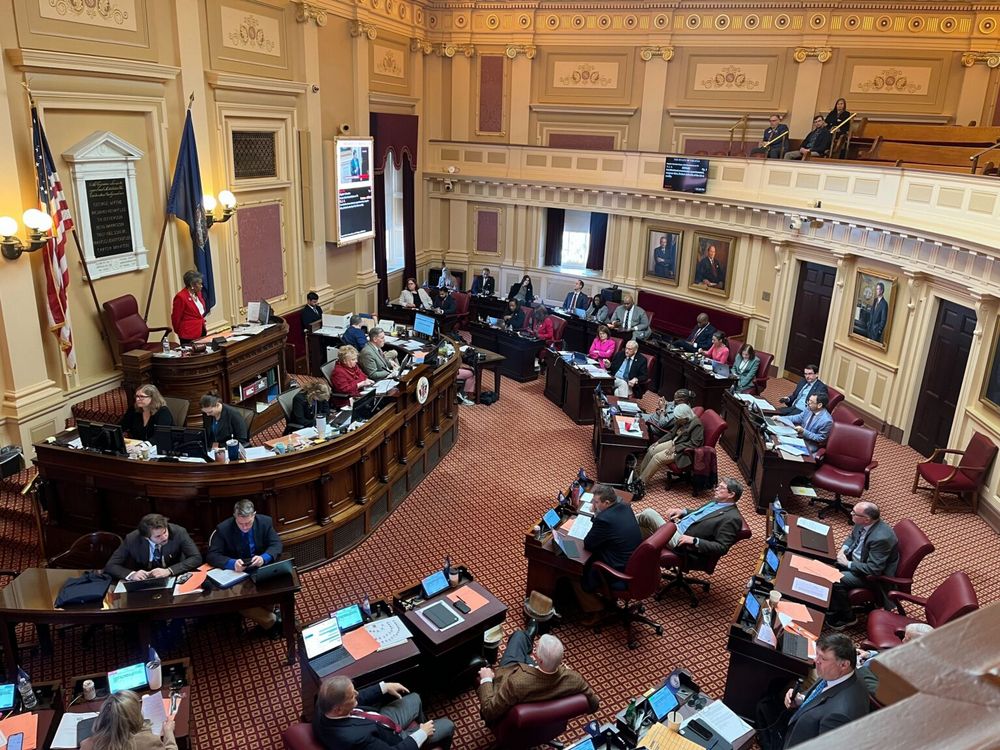

Policymakers now face a challenge: how to preserve the positive revenue flow from sports wagering while also ensuring that the industry contributes meaningfully to local job creation and economic development. Without adjustment, Massachusetts may be left with a revenue stream that enriches state coffers but does little to support its broader economic health.