Washington — A geopolitical flashpoint has turned into a betting frenzy. As relations between the United States and Venezuela deteriorate, online prediction markets are now letting traders wager on whether the U.S. will invade Venezuela in 2025, turning one of Latin America’s most volatile political standoffs into a speculative playground.

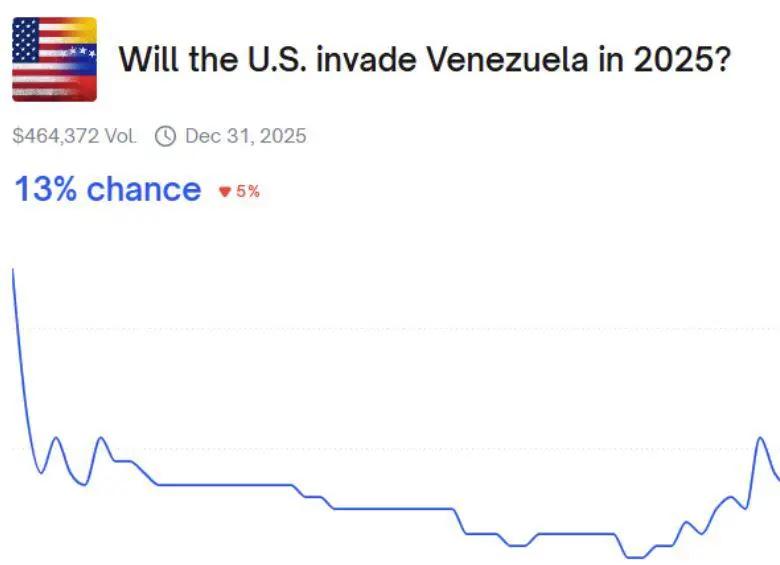

The latest trigger came after reports that Venezuelan President Nicolás Maduro placed a symbolic $100,000 bet that his government would survive any foreign intervention. While the claim hasn’t been officially verified, it has fueled an unusual surge in political wagers across decentralized platforms like Polymarket, where the contract “Will the U.S. invade Venezuela in 2025?” has traded between 10% and 20% odds in recent days.

BREAKING: The odds of Venezuela's Maduro losing power this year surge, after Trump authorized CIA ops.https://t.co/StgNuVOm9x

— Polymarket (@Polymarket) October 15, 2025

Another heavily traded contract — “Maduro out in 2025” — is drawing investors speculating on the president’s political future amid heightened international pressure and domestic unrest.

The tension escalated after U.S. airstrikes reportedly destroyed two Venezuelan vessels in the Caribbean suspected of drug smuggling, killing 11 crew members. President Donald Trump, in a statement widely covered by U.S. and Latin American outlets, confirmed he had authorized CIA operations inside Venezuela and accused Maduro’s regime of exporting criminals and narcotics into U.S. territory. Caracas called the move “a direct provocation” and vowed to defend its sovereignty.

What began as rumor trading has now evolved into a proxy indicator of public sentiment. The rise of blockchain-based prediction platforms means anyone — from political observers to crypto traders — can speculate on the likelihood of conflict in real time. For market participants, the odds act like a digital mood ring, signaling how credible the threat of U.S. intervention appears day to day.

Still, the practice has drawn criticism. Lawmakers and analysts warn that turning warfare into a betting event blurs ethical lines and risks amplifying misinformation. “When conflict becomes quantifiable, it also becomes trivialized,” one Washington security analyst told Reuters.

NYSE owner ICE to invest $2 billion in Polymarket as prediction markets go mainstream

Yet, as the geopolitical standoff deepens and U.S. intelligence operations expand, traders are watching these markets as if they were early-warning systems. If the rhetoric hardens and troop movements intensify, the numbers may move from mere speculation to something far more prophetic.