The fireworks this July 4th weren’t just in the sky—they exploded across the U.S. gambling world after Congress advanced the so-called “One Big Beautiful Bill,” a sweeping tax reform with a not-so-beautiful twist: starting in 2026, gamblers can only deduct up to 90% of their losses. That means even those who break even at the tables may find themselves paying taxes on phantom winnings.

Gambling professionals and analysts are sounding the alarm. A gambler who wins $100,000 and loses $100,000 would now owe taxes on $10,000 in theoretical net income. "It will kill professional gambling," warned Doug Polk, a renowned poker player. Sports betting analyst Rufus Peabody called it a "devastating misunderstanding of how gambling works."

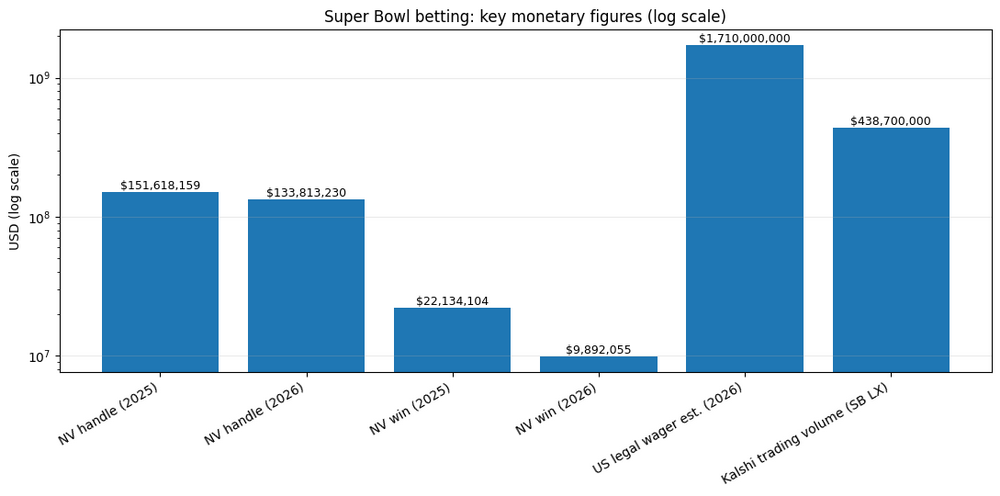

The measure, projected to generate $1.1 billion in tax revenue, is part of a broader attempt to offset federal spending. But critics argue that it unfairly penalizes an industry already under intense regulation and scrutiny. The American Gaming Association (AGA) has expressed conditional support for the bill but opposes this provision, warning it could push high-volume players underground.

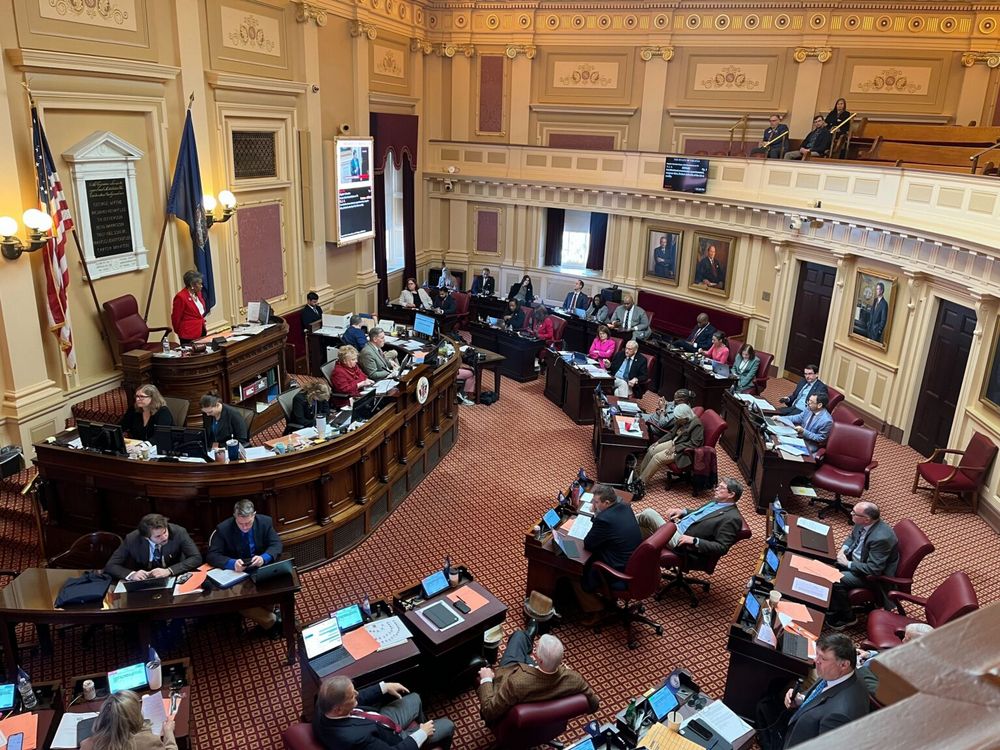

Even lawmakers in gambling states are pushing back. Congresswoman Dina Titus of Nevada has introduced a bill to restore full deductibility of losses, noting that professional gamblers are being lumped in with casual hobbyists. “This is not about ducking taxes,” she said. “It’s about fairness and economic survival.”

Major casino operators like MGM and Caesars remain mostly quiet, as the tax primarily targets individual players. Still, insiders warn it could reduce VIP traffic and influence tournament economics. As analysts at Mundo Video point out, the risk isn’t limited to Las Vegas. A chilling effect on professional gambling in the U.S. could ripple across online platforms, global odds markets, and cross-border operator strategies. For an industry reliant on liquidity and volume, taxing losing bets could prove catastrophic.