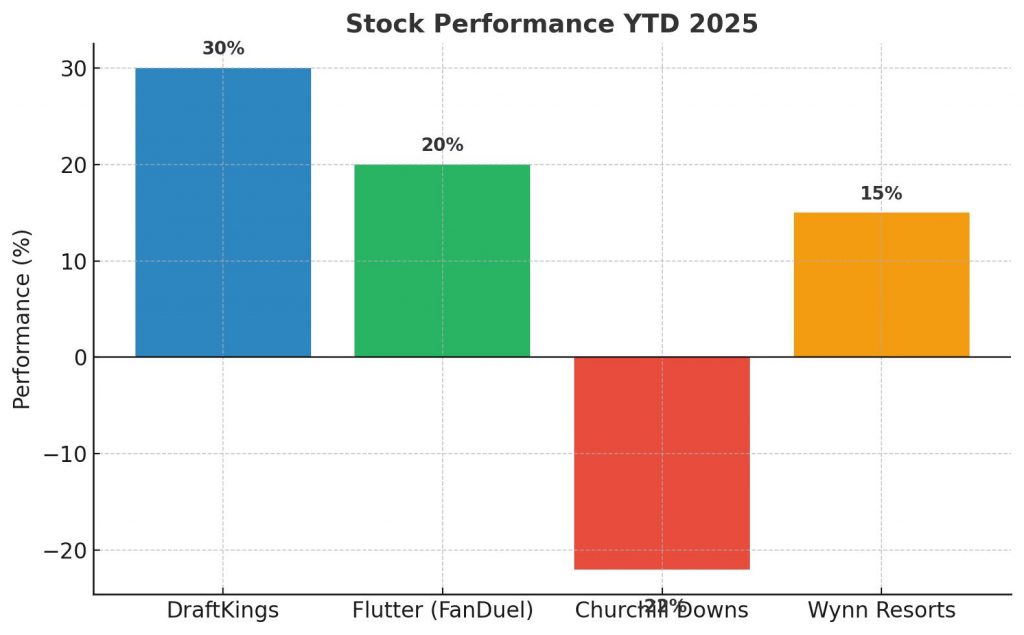

Wall Street, New York — The online sports betting sector in the United States is undergoing dynamic changes in 2025, fueled by the continuing impact of Wall Street Bets, a well-known online forum influencing market behavior. Major companies such as DraftKings and FanDuel, along with gambling giants like Churchill Downs and Wynn Resorts, are drawing increased investor attention. Recently, DraftKings’ stock was rated as overweight by J.P. Morgan, and the past week saw notable volatility, including a 10.9% increase in Wynn Resorts’ shares contrasted by a 12.9% drop for Six Flags Entertainment, highlighting an unsettled market shaped by regulatory and investor forces.

David Katz, Senior Analyst at Jefferies, emphasized the evolving environment: “The prospect of total addressable market expansion via prediction markets presents an enticing but complex opportunity for established operators,” underlining the significant but nuanced growth potential in this area.

This expansion is framed by a shifting legal framework that governs online sports betting and prediction markets. Current state-level regulations oversee operating licenses for sportsbooks, regulated by state gaming commissions and tribal authorities. Operators must carefully navigate a complex interplay of state laws, federal statutes, and the unresolved legal status of prediction markets—contracts based on event outcomes that challenge existing legislation.

This legal uncertainty compels companies to innovate cautiously while maintaining regulatory compliance, especially in key states like California and Texas, where online sports betting remains prohibited but lobbyists and lawmakers continue to push for reform.

Economically, this regulatory flux is spurring strategic investment and operational shifts within the gambling industry. Optimism surrounds Q3 expectations for the Las Vegas Strip properties amid cautious investor sentiment about political developments in states yet to legalize online sportsbooks. The sector’s market capitalization and geographic reach could benefit from favorable regulatory changes, though risks endure due to the unpredictable policy environment that could affect expansion trajectories.