A fresh wave of Wall Street attention is landing on listed online-betting operators after a high-profile insider purchase at DraftKings (NASDAQ: DKNG) highlighted how investors are reframing the sector’s risk—and opportunity—set.

On Feb. 17, 2026, DraftKings board director Harry Sloan purchased 100,000 shares on the open market for nearly $2.2 million, at a weighted average price of $21.85 (executed between $21.76 and $22.00). The transaction lifted his direct holdings to 350,219 shares, according to the filed disclosure.

The buy came immediately after a sharp bout of volatility. DraftKings shares fell nearly 14% on heavy trading—more than five times average volume—following the company’s earnings release and, in particular, its 2026 outlook. The stock began to rebound, closing up 3.8% the following Tuesday and trading higher again early Wednesday.

At the center of the selloff was guidance discipline. DraftKings had previously projected 2025 adjusted EBITDA of $900 million to $1 billion, but finished the year at $620 million.

For 2026, management guided to $700 million to $900 million, a range CEO Jason Robins described as intentionally conservative to restore credibility after earlier revisions.

Analysts largely framed Sloan’s purchase as a confidence signal, while acknowledging the “new thesis” forming around the group: profitability trajectory now competes with policy and product-structure uncertainty. Truist’s Barry Jonas cited a “confluence” of conservative guidance, prediction-market uncertainty, and fears of higher state taxes, cutting his target to $33 from $45 while keeping a Buy rating. Deutsche Bank’s Steve Pizzella reiterated Hold, lowering his target to $26 from $36.

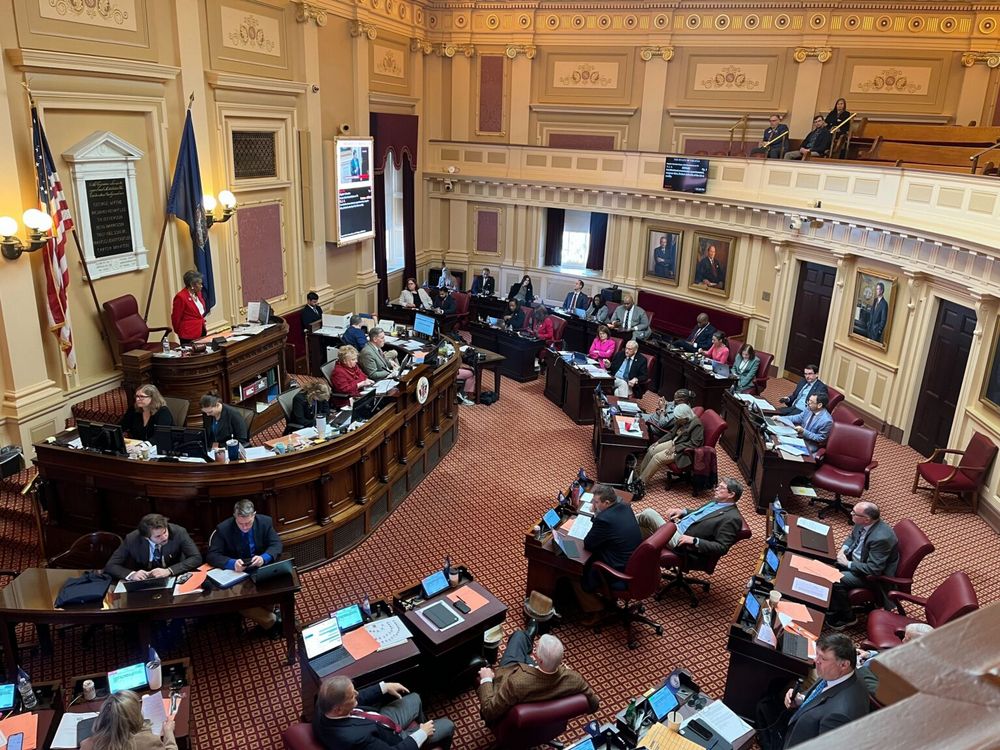

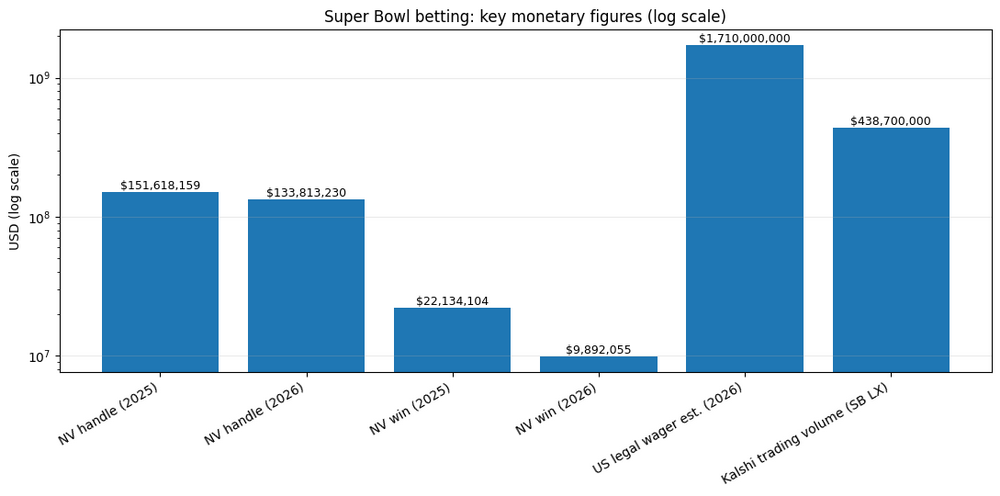

That prediction-market overhang has intensified as U.S. states move against platforms like Kalshi, arguing event contracts resemble unlicensed sports betting—an expanding legal fight with direct implications for how wagering demand may be regulated (and monetized) going forward.