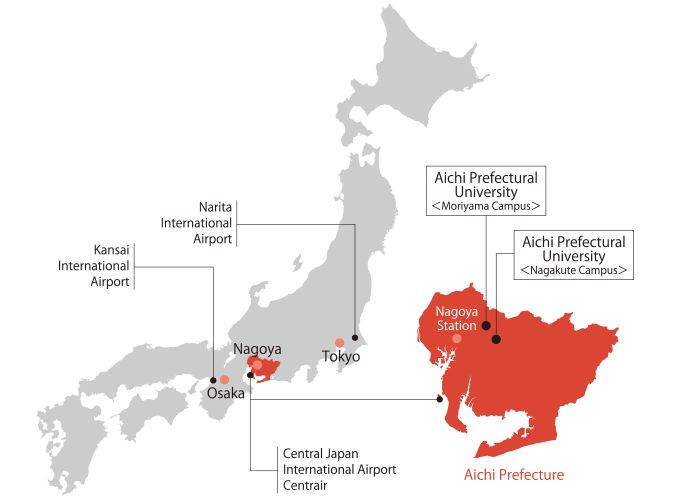

Japan’s Aichi Prefecture is restarting preparations to compete for an integrated resort (IR) casino license, positioning itself for the country’s second national application round expected in 2027. Multiple reports citing local Japanese media say the prefecture has decided to re-enter the race after shelving earlier plans during the pandemic, with Governor Hideaki Omura expected to formalize the renewed push.

Aichi is expected to begin with a market-sounding phase—typically an RFI (request for information)—to gauge developer appetite and partnership structures before moving to a full bid process. The location most often referenced is reclaimed land near Chubu Centrair International Airport, a connectivity-first pitch that would frame the project as a tourism and MICE (meetings, incentives, conferences, exhibitions) gateway for central Japan.

The timing is driven by the central government’s schedule. The Japan Tourism Agency has indicated the next window for local governments to submit IR plans will run from May 6 to November 5, 2027, giving prefectures roughly a year to line up private-sector operators, financing, and local approvals.

Japan’s IR law allows up to three certified IRs nationwide, but only one has been approved so far: Osaka, where a consortium led by MGM Resorts International and ORIX has broken ground on a project priced at ¥1.27 trillion and targeting an opening around 2030. With Osaka effectively occupying the first slot, the 2027 round is widely viewed as a contest for the remaining two licenses—raising the stakes for candidates like Aichi that can credibly argue international access and economic spillovers.

Aichi will not be alone. Coverage of the upcoming round consistently points to other localities preparing bids, including Hokkaido, and potential re-entrants such as Nagasaki, which previously pursued an IR but was not selected.

For international investors and operators, Aichi’s reactivation is a signal that Japan’s IR pipeline is no longer “Osaka-only.” The next 18 months will likely hinge on who can present the most bankable mix of site readiness, operator quality, financing credibility, and regional tourism strategy—all while navigating local politics and national scrutiny.