In September 2025, several Asian jurisdictions, including Philippines, Singapore, and Macau, have intensified enforcement of gambling regulations, leading to significant shifts in bettor behavior. Recent data indicates that over 40% of formerly compliant punters have moved to unregulated black market platforms in the last few months. This rise highlights growing challenges regulators face balancing market oversight with preventing illegal activities.

Alejandro H. Tengco, chair of the Philippine Amusement and Gaming Corporation (PAGCOR), acknowledged the unintended impact of these policies. He stated, “Aggressive enforcement measures, while well-intentioned, have unfortunately pushed many players away from safe, licensed environments. We must carefully balance control with accessibility to protect consumers and preserve industry health.”

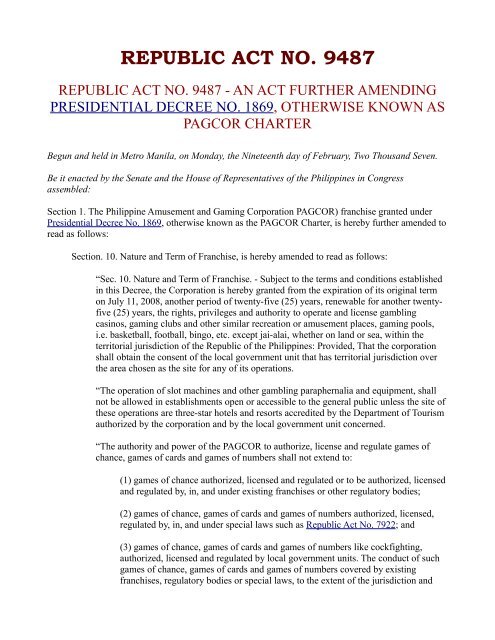

The legal landscape includes frameworks such as the Philippines' Republic Act No. 9487 and Singapore’s Remote Gambling Act, designed to promote transparency, fairness, and social responsibility. However, the introduction of stricter compliance costs, wager size caps, and more rigorous identity verifications has discouraged participation in licensed venues. Experts warn that overly restrictive regulations may inadvertently encourage the growth of unlicensed operators, undermining regulatory objectives.

Economically, the expansion of black market gambling diverts revenue from governments and licensed businesses, threatening the stability of Asia’s broader gaming sector. This trend also pressures regulatory bodies to reconsider policies and strengthen international cooperation against illegal betting. Licensed operators face increasing challenges with customer retention and rising compliance demands, complicating growth and innovation across the region’s gaming markets.