As of January 15, 2025, Thailand is emerging as a key player in Asia’s casino industry. Led by Prime Minister Paetongtarn Shinawatra, this initiative aims to diversify the economy, create jobs, and attract international investment. The Prime Minister has emphasized that beyond its economic impact, legalizing casinos will effectively combat illegal gambling, which generates approximately 600 billion baht annually.

This project has caught the attention of major international players, including MGM Resorts International, Las Vegas Sands, Melco Resorts & Entertainment, and Genting Group, all of which have expressed interest in developing integrated resorts in Thailand. These projects could feature casinos, luxury hotels, shopping malls, and entertainment venues, with an estimated initial investment of 200 billion baht (approximately USD 6 billion).

Prime Minister Paetongtarn Shinawatra

The projected economic impact is significant, with annual revenues expected to exceed 400 billion baht (USD 12 billion) and the creation of over 50,000 direct jobs. Additionally, casinos are anticipated to boost tourism in Thailand, attracting up to 6 million additional visitors annually, particularly from nearby markets such as China, Malaysia, and India.

Four out of Macau’s six casino concessionaires have expressed interest in investing in Thailand.

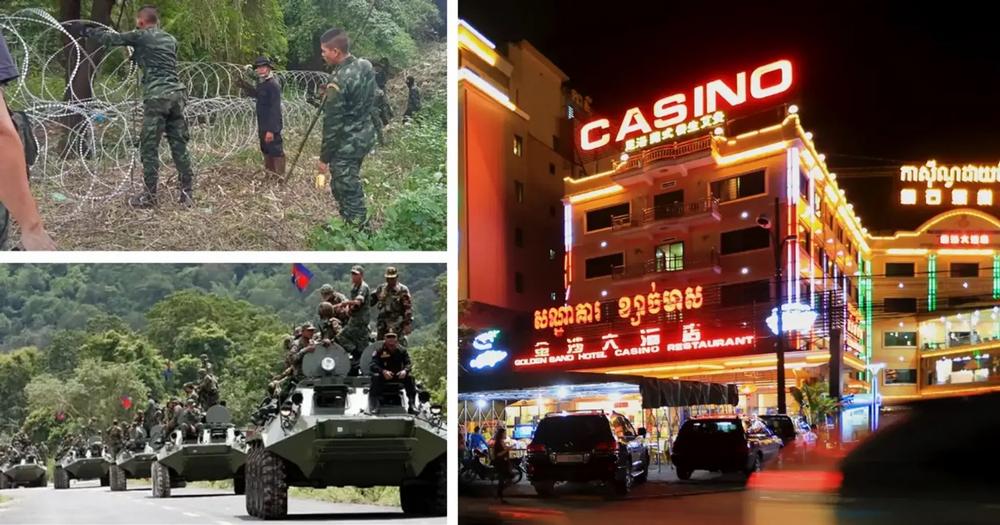

The development of casinos in Thailand could significantly affect neighboring countries that already operate or are planning casino projects. Cambodia, which currently generates around USD 2 billion annually from casino revenues, may see a decline in its Thai clientele, which forms a large part of its income. This could push Cambodia to innovate or lower taxes to remain competitive.

Singapore, whose two main casinos generate more than USD 6 billion annually, might lose part of its Asian clientele seeking more affordable and accessible options.

Macau, the industry leader with revenues exceeding USD 36 billion, could face a shift of Chinese players toward Thailand due to its geographical proximity and lower costs. Vietnam, with several casino projects in development, might also face challenges if international investors prioritize Thailand as a more attractive emerging market.

Malaysia’s Genting Highlands, one of its primary gaming destinations, could also be impacted by competition from modern, new options in Thailand.

Thailand Casinos Inch Closer to Reality, Could Open before MGM Osaka.

While competition is clear, opportunities for cooperation may also arise. Casino operators in neighboring countries could explore partnerships with Thai developers to share customers, technologies, and best practices. Additionally, Thailand could become a transit point within a regional casino tourism circuit, indirectly benefiting the entire region.

With a strategic location, government support, and the interest of global investors, Thailand is set to reshape the dynamics of the casino industry in Asia, creating challenges and opportunities for its neighboring countries.