Macau, October 5, 2025 — Shares of major casino operators with exposure to Macau fell sharply this week after early data from China’s Golden Week holiday showed weaker-than-expected travel and visitor numbers, dampening investor optimism about a strong recovery in gaming revenues.

Analysts and investors had anticipated a surge in tourism during the eight-day national holiday — historically one of the most profitable periods for Macau’s gaming industry. However, figures released by local authorities indicated that the total number of arrivals and hotel occupancy rates were below bullish forecasts, triggering a sell-off in gaming stocks.

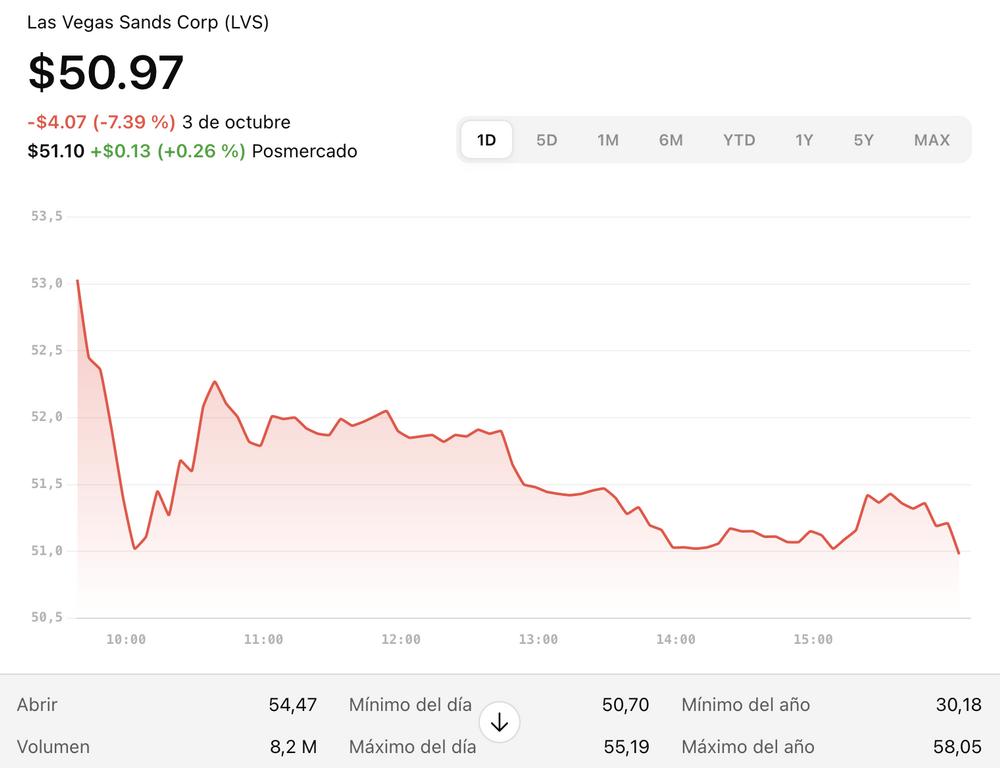

Wynn Resorts (NASDAQ: WYNN) shares dropped nearly 6 % on Friday, while Las Vegas Sands Corp. (NYSE: LVS) fell about 5.5 %. Melco Resorts & Entertainment (NASDAQ: MLCO) and MGM China Holdings also posted declines as traders reassessed near-term earnings expectations for the sector.

According to a note from Citi analysts, visitor traffic growth was “respectable but short of the exuberant market expectations.” The bank added that a portion of mainland travelers had started their trips earlier than usual this year, resulting in softer data during the official holiday window.

Despite the setback, analysts emphasized that Macau’s year-to-date tourism figures remain significantly higher than in 2024, underscoring the territory’s continued recovery after pandemic-related disruptions.

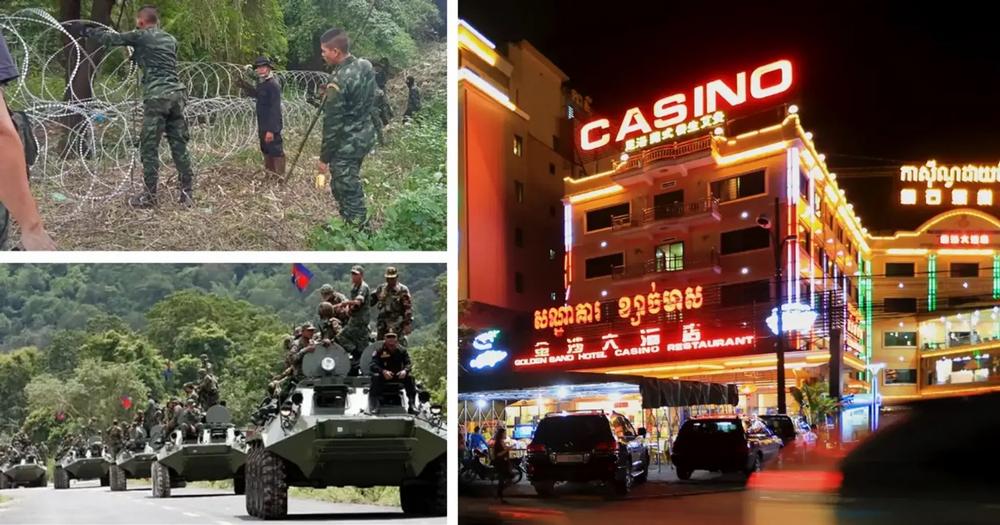

“The market had simply priced in perfection,” said one industry observer. “Anything less than record-breaking numbers was bound to disappoint.” Weather conditions also played a minor role, with intermittent storms affecting regional transport in southern China during the first days of the holiday. However, economists pointed out that the broader issue lies in shifting consumer habits — younger tourists are spending more on shopping and entertainment than on casino gaming, slightly diluting revenue growth for operators.

The Hang Seng Index’s gaming sub-sector lost more than 4 % this week, erasing part of the gains accumulated earlier in the third quarter. Investors are now watching closely for official gross gaming revenue (GGR) data for October, which will offer a clearer picture of whether the slowdown is temporary or the start of a broader cooling trend.

For the moment, market sentiment remains cautious. While Macau continues to attract millions of visitors, the Golden Week figures serve as a reminder that recovery in the gaming hub will likely follow an uneven trajectory — one shaped as much by travel patterns and consumer behavior as by luck at the tables.