Macau's gaming industry commenced 2025 with a gross gaming revenue (GGR) of MOP$18.25 billion (US$2.27 billion) in January, marking a 5.6% decline compared to the same month in 2024. This performance fell short of analysts' expectations, who had anticipated a 6% year-on-year increase for the combined months of January and February.

The subdued start to the year was not entirely unforeseen. Analysts had projected a moderate first quarter for 2025, citing challenging comparisons to the first quarter of 2024, which benefited from higher VIP volumes and favorable hold rates. Additionally, December 2024's GGR experienced a 2% year-on-year decline, coinciding with Chinese President Xi Jinping's visit to Macau for the 25th anniversary of the Macau SAR. Analysts believe the heightened security measures during this period negatively impacted casino earnings.

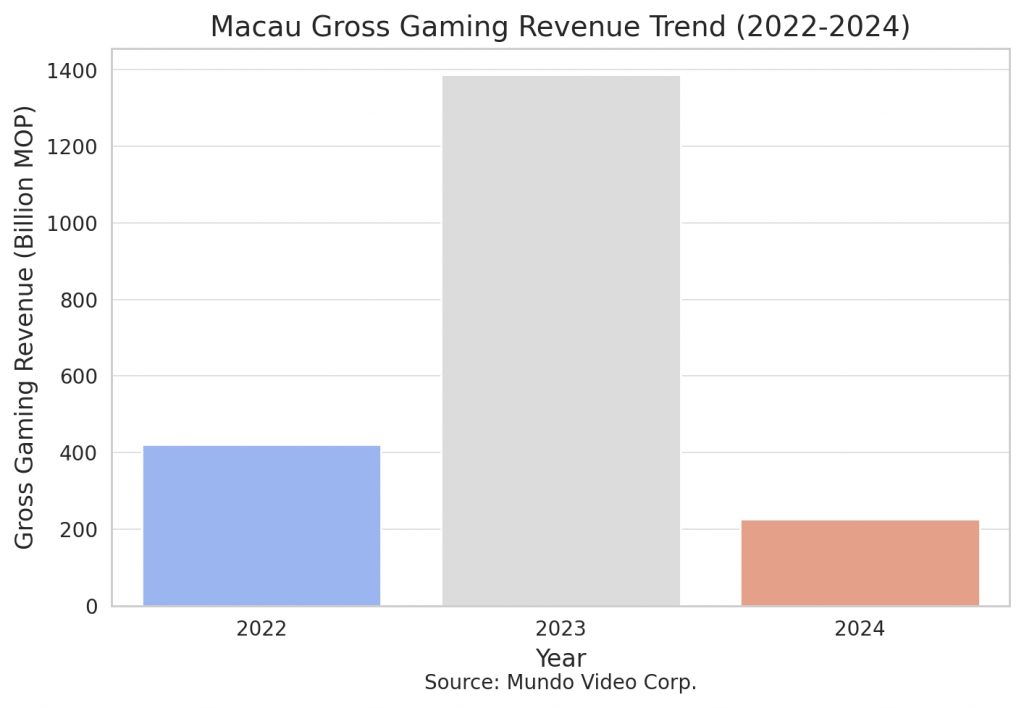

Despite the early dip in 2025, the Macau government remains optimistic, forecasting an annual GGR of MOP$240 billion (US$29.7 billion) for the year. If achieved, this would represent a 5.8% increase from the MOP$226.8 billion recorded in 2024.

Analysts share this positive outlook. Goldman Sachs projects an 8% year-on-year growth in Macau's GGR for 2025, driven by robust travel spending among Chinese tourists.

Similarly, S&P Global Ratings estimates a 5-6% growth in GGR for the year, with mass gaming revenue expected to be 15-20% above pre-pandemic levels.

Several factors contribute to this optimism. Improved visa policies and a strengthening Chinese economy are anticipated to boost visitor numbers. Additionally, the return to traditional money movement methods, such as the use of Macau's UnionPay pawn shops, following a crackdown on illegal money exchange operations, is expected to facilitate gaming transactions.

Non-gaming Potential in Macau: government is actively trying to resolve this situation.

However, challenges persist. Macau's economy remains heavily reliant on the gaming sector, which contributes about 80% of tax revenues. The Chinese government's anti-corruption drive and travel restrictions during the pandemic have adversely affected the VIP segment, leading to a decline in high-roller revenues.

Macau’s Gaming Industry: Navigating Orderly Development Amidst Calls for Diversification

In response, there is a concerted effort to diversify Macau's economy beyond gaming. During his December visit, President Xi urged Macau to establish new industries and better integrate with mainland China's development strategies, including increased economic integration with the Greater Bay Area and participation in the Belt and Road Initiative.

As Macau navigates these challenges and opportunities, the gaming industry's performance in the coming months will be closely watched as an indicator of the region's economic resilience and adaptability.