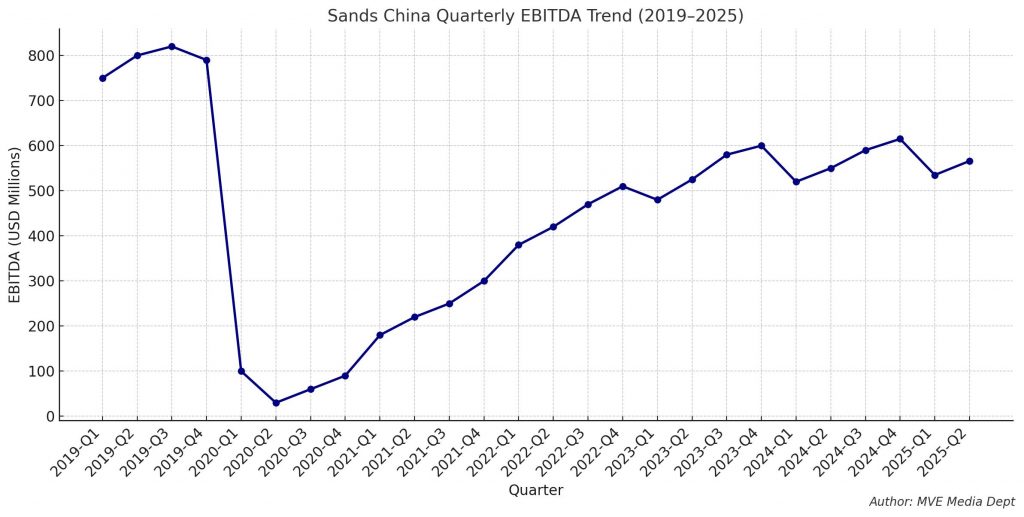

Sands China reported a subdued start to 2025 with first-quarter EBITDA at $535 million USD, marking a 12.3% year-over-year decline and game gross revenue (GGR) slipping 2% quarter-over-quarter to $1.6 billion USD. The company reiterated its commitment to intensify client reinvestment strategies, aiming for an ambitious $2.7 billion USD EBITDA annually. Industry analysts, including Citi, affirm the target’s feasibility, forecasting 2026 EBITDA to reach approximately $2.77 billion USD.

The second quarter reflected gradual recovery, with adjusted EBITDA improving 0.9% year-over-year to $566 million USD and net revenues growing 1% to $1.797 billion USD, equivalent to 84% of 2Q19 pre-pandemic levels.

Sands China CEO Wilfred Wong hailed the efforts, stating, “Our strategic reinvestment into the mass market segment is beginning to bear fruit, demonstrating resilience amid operational headwinds.”

The regulatory context for Sands China is shaped by Macau’s gaming law (Law No. 16/2001), which governs licensing and operational frameworks to maintain sector integrity and economic sustainability. Under this regime, reinvestment in customer incentives—such as rebates and marketing—must align with policies designed to prevent market distortions and promote responsible gaming. Sands China’s increased reinvestment rate of 23% in the mass market reflects a tactical maneuver within these legal boundaries to boost competitiveness.

Sands China Battles Fierce Competition in Macau’s Base Mass Market Segment

Market implications of Sands China’s strategy are multifaceted. The full opening of The Londoner Macau hotel, adding 2,400 suites, notably increased mass market game revenues by 8% in the second quarter, surpassing industry averages and contributing an EBITDA jump of 34% quarter-over-quarter. Conversely, performances at other properties like The Parisian declined by 33%, signaling uneven recovery across portfolios.

Meanwhile, Macau’s visitor growth—14.9% higher in the first half of 2025 to 19.22 million tourists, with a 25.8% rise in same-day visitors and a 19.3% increase from mainland China—further supports market optimism.

As Sands China navigates profit pressures and operational challenges, its progressive reinvestment strategy and capacity expansions resemble either a clearing horizon or an approaching storm cloud for the Macau gaming sector. This recalibration will be decisive in determining whether sustainable growth is unlocked or new regulatory scrutiny emerges.