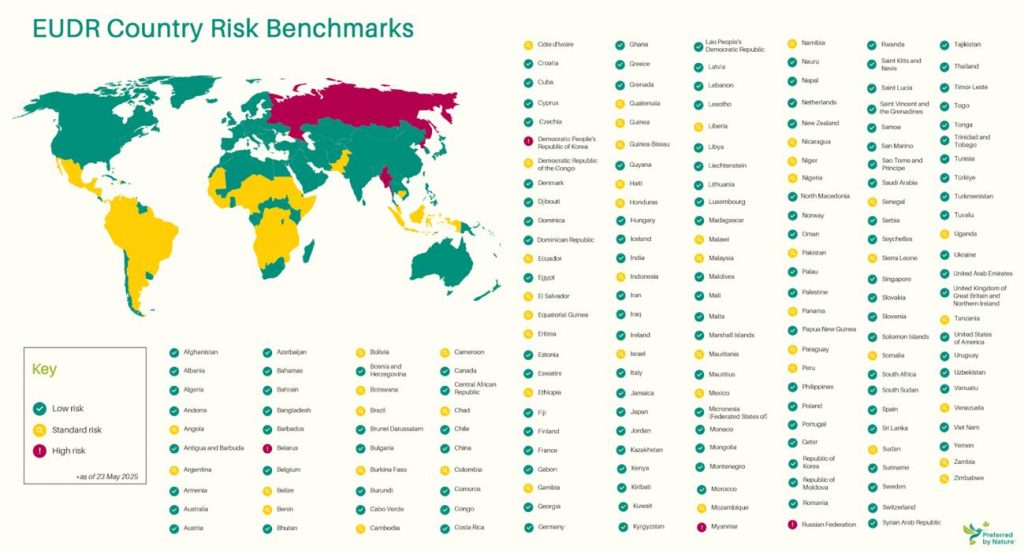

The European Parliament approved the European Commission's recommendation on July 9, 2025, to remove the Philippines from the EU’s high-risk money laundering and terrorist financing list. The decision follows the Financial Action Task Force’s (FATF) February delisting and marks the conclusion of a €1 billion+ investor flows realignment, 213 AML/CFT reforms, and 60 days of parliamentary review amid a regional financial system storm.

The Philippine Anti-Money Laundering Council (AMLC) described the move as a milestone in enhancing the country’s financial appeal for overseas investors and compliance reputation with European banks.

“The delisting proves our commitment to international standards and regulatory cooperation,” hailed AMLC chief Clayton Cruz, reflecting on the impact on correspondent banking and remittance corridors.

Philippines’ casino boom gains momentum after FATF grey list removal

Under EU law, the move amends Directive (EU) 2015/849 and EU delegated regulation (C(2025)3815), de‑flagging the Philippines, Barbados, Jamaica, Senegal, Uganda, and the UAE. Officials warn that relisting could trigger €500 million in compliance costs and renewed due diligence by EU financial institutions.

With Manila now clear of the “high-risk” label, cross-border financial services—including online gaming payments and remittances—are expected to proceed with fewer delays and lower scrutiny among EU banks, potentially enhancing regional economic integration.

As this regulatory quake reshapes Manila’s fiscal landscape, one question looms over foreign investors and ASEAN policymakers:

Will this delisting unleash a new wave of EU-Philippines financial engagement—or expose underlying AML vulnerabilities?