As 2025 draws to a close, Las Vegas and Macau are sending a similar headline to global investors: gaming revenue is holding up, but momentum is clearly slowing. Under the surface, however, the engines driving both markets look very different.

On the U.S. side, Nevada casinos reported roughly US$1.35 billion in gaming win in October 2025, about 5% higher than a year earlier. The Las Vegas Strip contributed close to US$749 million, up more than 8% year-on-year, with a spectacular 69% jump in baccarat win powering the result. The catch: visitor numbers and air traffic fell, with Harry Reid International Airport posting an 8.2% decline in passengers, the steepest monthly drop of the year. Vegas is increasingly relying on high rollers, premium events like Formula 1 and stronger spend per visitor, rather than pure volume.

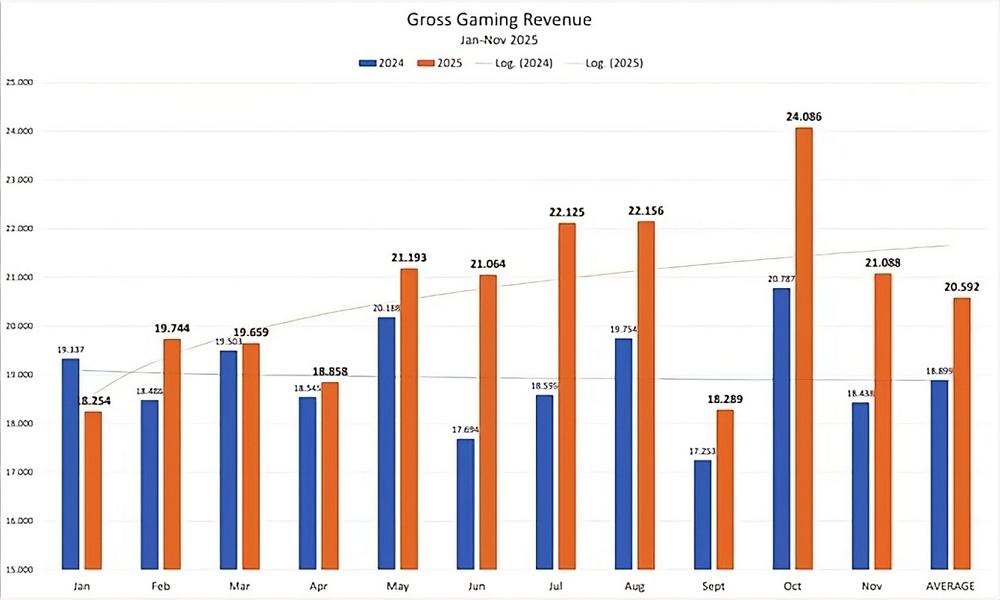

Across the Pacific, Macau’s November gross gaming revenue (GGR) reached just above MOP 21 billion (around US$2.6 billion), a 14.4% increase compared to November 2024. Yet GGR was down roughly 12.4% from October, when the city generated over MOP 24 billion, its best month since the pandemic. For the first eleven months of 2025, Macau’s GGR totals about MOP 226.5 billion, up 8.6% year-on-year and already very close to the government’s full-year target of MOP 228 billion.

Unlike Las Vegas, Macau’s story is less about headline events and VIP swings and more about the resilience of the premium-mass and mass-market segments, supported by stable visitation from mainland China and the Greater Bay Area. While traditional junket-driven VIP action is a shadow of its former self, operators have rebuilt their business models around non-gaming, mass tables and slot floors.

For international readers and investors, the message is clear: Vegas is leaning on volatility (F1, baccarat, high-end play); Macau is leaning on scale (mass and premium-mass). Both markets are growing in low double digits, but the risk profiles could not be more different.