Paraguay’s regulated gaming industry is closing 2025 on a high note after reporting more than USD 28.7 million in revenues between January and November, confirming one of the strongest growth stories in Latin America’s licensed gambling market.

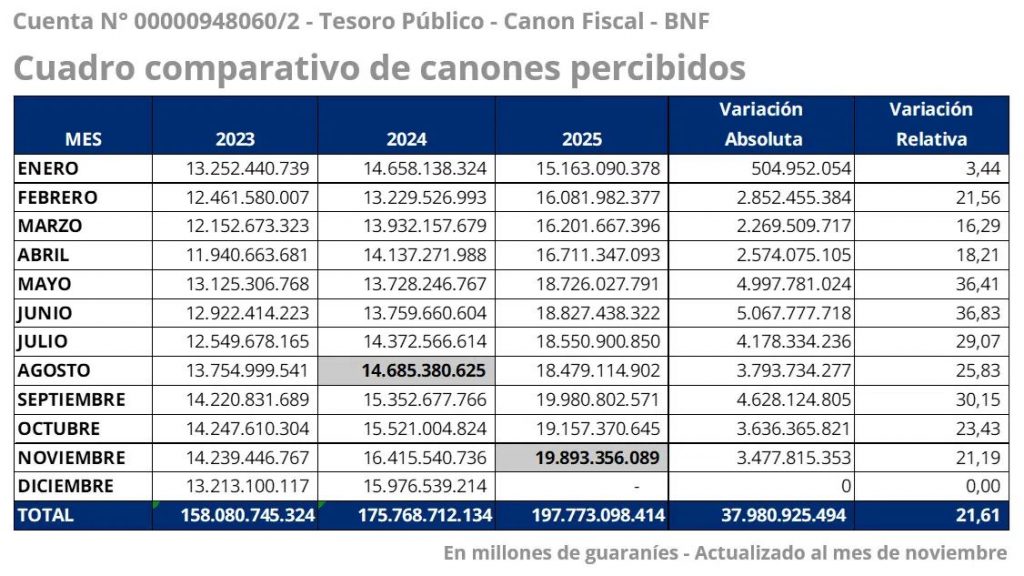

According to the latest report from the National Gambling Commission (Conajzar), the sector generated PYG 197,773,098,414 in fees over the first 11 months of the year, equivalent to USD 28,745,084.22 at the official exchange rate.

November was particularly strong. Conajzar reported monthly revenues of PYG 19,893,356,089 (around USD 2.89 million), up 21.19% year-on-year, reinforcing the upward trend already visible in previous reports covering January–August, when collections had surpassed USD 19 million.

The positive figures also show how quickly Paraguay’s new regulatory and tax structure is scaling. In 2024, Conajzar posted record annual revenues of about PYG 175,768 million, roughly USD 22.2 million, and publicly set the ambition of tripling that amount in 2025, supported by closer integration with the recently created National Directorate of Tax Revenues (DNIT). With eleven months already above the full-year 2024 total, the goal of a historic year looks increasingly realistic.

Paraguay levels up: Gambling revenue hits record $2.3 million in May as reforms pay off

Regulators attribute the momentum to a combination of stricter control of concessions, better tax collection and a clear focus on channeling play into the licensed ecosystem. The modernization of procedures between Conajzar and DNIT has tightened oversight of operators while keeping the market attractive for investment, particularly in lotteries, betting and electronic gaming.

Beyond the headline numbers, the growth of the regulated sector is also framed as a win for public finances. Revenues from gaming fees flow directly to the national treasury and to social programs defined in Paraguay’s legislation, positioning legal gambling as a complementary tool for funding development projects, infrastructure and social policies.

With Latin American jurisdictions competing to modernize their gambling frameworks, Paraguay’s performance in 2025 sends a clear message: a transparent regulator, robust tax collection and an orderly concession system can turn a relatively small market into a consistent revenue engine in just a few years.