Colombia’s gambling sector is reeling from what insiders are calling a double punch of taxation—a sudden surge in fiscal pressure that could put hundreds of legal operators at risk.

In early 2025, the government introduced a 19% value-added tax (VAT) on every wager placed through licensed online gambling and sports betting platforms, citing national security concerns under the state of emergency in Catatumbo.

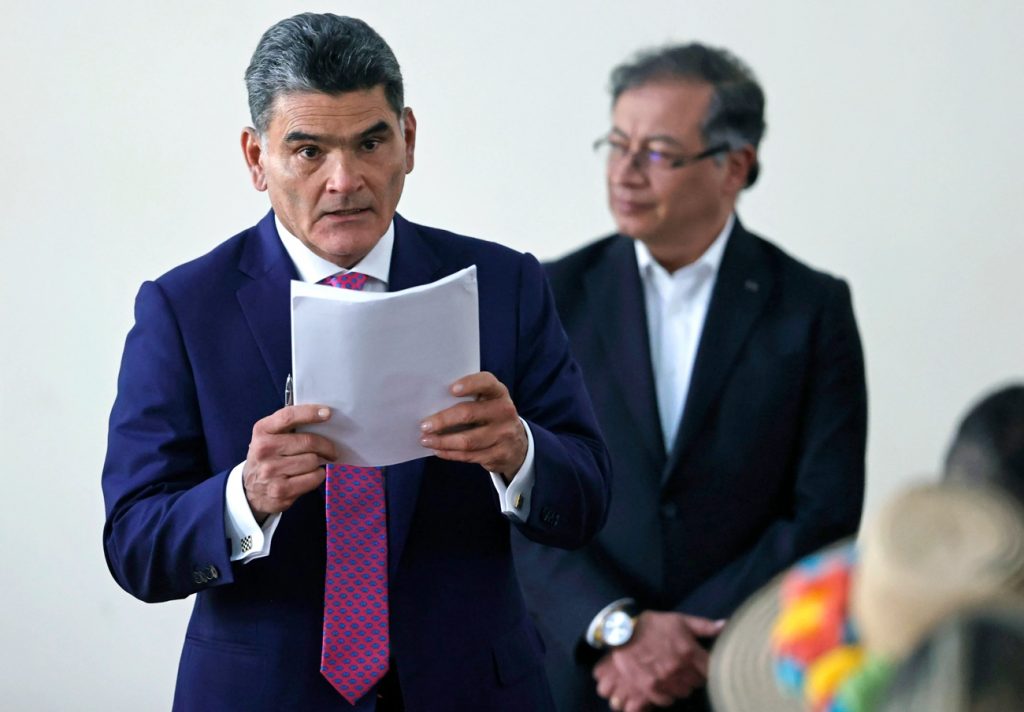

Defended by Procurador General Gregorio Eljach, the VAT was framed as a necessary step to finance humanitarian operations. But since its implementation, the regulated sector has reported a 30% drop in gross gaming revenue, triggering alarm among operators and analysts alike.

Now, the pressure has intensified. On June 1, Decree 0572 of 2025 will take effect, introducing a new 3.5% self-withholding income tax for all companies engaged in gambling activities (CIIU 9200), covering both land-based and online operators. Previously, these businesses were subject to a flat 1% withholding tax, collected by third parties.

Under the new model, operators must calculate and pay their own taxes monthly, directly increasing their administrative burden and financial strain.

Industry groups like Fecoljuegos warn that these cumulative measures could destabilize the formal market, which has already been struggling to compete with illegal and unregulated alternatives. “We’re punishing those who are doing things right,” one operator commented anonymously.

Critics argue that Colombia is overreaching, creating a hostile fiscal environment for a sector that had begun to show signs of sustainable growth and international confidence. If these policies continue unchecked, the country risks losing not just revenue, but credibility.