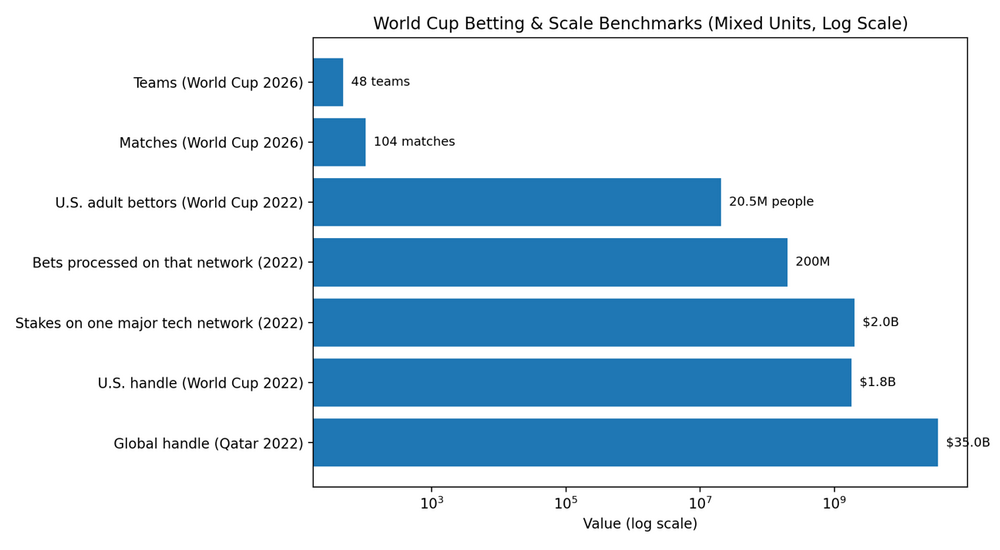

With 48 teams and 104 matches across the United States, Mexico and Canada, the 2026 FIFA World Cup will offer far more “betting inventory” than prior editions, extending the tournament footprint to 104 fixtures and a longer calendar window.

That expansion matters because volume tends to scale with match count and market access. For context, widely cited market estimates put global stakes around $35 billion during Qatar 2022, roughly +65% versus 2018—establishing a high-water mark that many expect 2026 to surpass on sheer scale and reach.

In the U.S., an industry estimate pegged 2022 World Cup wagering at about $1.8 billion from roughly 20.5 million adult bettors. With legal sports betting now available across a large majority of U.S. jurisdictions, the “addressable” base for 2026 is structurally larger than it was in 2022.

For investors, the key is translating handle into revenue. Sportsbooks earn gross gaming revenue (GGR) via the hold (often mid-single digits), so a surge in handle doesn’t automatically mean a proportional surge in profit. The World Cup tends to bring heavy recreational volume, but it also brings promotion intensity and pricing competition—so watch whether operators defend margin.

Investor lens: three metrics that will decide “who wins” financially

- Hold and promo efficiency: Track whether operators maintain disciplined pricing and limit free-bet inflation as match volume peaks.

- Payments and platform throughput: Major tournaments stress test rails. In 2022, one large sportsbook technology network reported 200+ million bets and $2+ billion wagered across its clients during the event—useful as a proxy for infrastructure demand.

- Customer quality (not just sign-ups): The best outcome is converting first-time event bettors into retained customers without overpaying for acquisition.