Recent market studies published in 2025 confirm sustained growth in Australia’s online gambling sector despite restrictive regulations. Projections show the legal market growing at a compound annual growth rate (CAGR) between 5.67% and 5.88% from 2026 to 2034, with offshore illegal markets valued at AU$3.9 billion in 2025 posing significant challenges to onshore operators.

Australia’s regulatory environment restricts online gambling to sports betting and lotteries, prohibiting online casinos and poker. This has driven 36% of the online gambling volume offshore to illegal operators, including 25% in products not allowed legally such as live in-play betting. Technological advances, mobile betting adoption accounting for 80% of wagers, and growth in crypto-casino niches contribute to sustained market expansion.

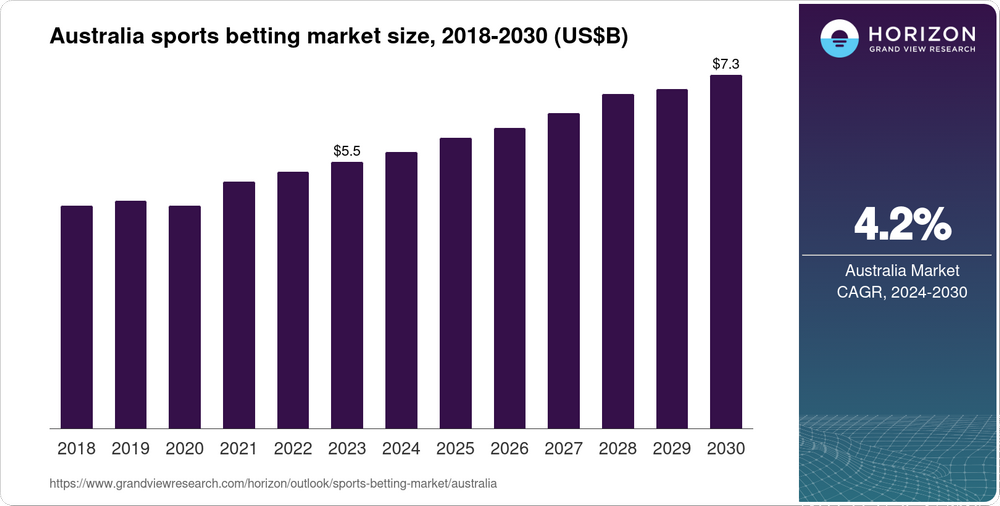

The legal online gambling market in Australia was valued at USD 5.5 billion in 2025, with forecasts reaching USD 9.0 billion by 2034 at a CAGR of 5.67%. The casino segment is expected to grow faster, at 10.4% CAGR from 2025 to 2034, targeting over USD 1 billion by 2030. In contrast, the offshore illegal market doubled since 2019 to AU$3.9 billion (USD 2.53 billion) in 2025 and is projected to reach AU$5 billion by 2029. These data highlight persistent fiscal losses for governments and market fragmentation.

Key actors include institutional and retail investors, authorized onshore operators, government regulators, and offshore illegal sites. Responsible Wagering Australia (RWA) underscores the need for a strong national framework to keep the onshore market competitive and protect tools like “BetStop” from offshore undermining. Market analysts from IMARC Group cite technological innovation and evolving consumer preferences as growth drivers despite regulatory hurdles.

Alarming surge: More Aussie teens gamble than play sports, report reveals

Looking ahead, the sector faces uncertainties around pending national regulations aimed at enhancing onshore competitiveness.

Projections anticipate offshore market volume of AU$5 billion by 2029, while onshore revenues grow steadily. Investor interest remains due to 5-10% CAGR opportunities, though regulatory crackdowns on crypto and offshore operators could disrupt growth trajectories. The balance between consumer protection and market expansion will be critical in the coming years.