Europe’s regulated gambling market is under unprecedented pressure, as a new study by Yield Sec for the European Casino Association (ECA) revealed that unlicensed operators captured the majority of online gambling revenue in 2024. The report estimates that European governments collectively missed out on €20 billion in tax revenue last year, highlighting the urgency of stronger enforcement.

The findings, published in early 2025 and reported by outlets illustrate the scale of the black-market problem:

- 71% of Europe’s online gambling revenue flowed through unlicensed operators, equal to €80.6 billion.

- By contrast, regulated operators represented only 29% of the market, or €33.6 billion.

- Nearly 92% of all online gambling-related content viewed by consumers was linked to illegal platforms.

- Around 18% of Europe’s population — approximately 81 million people — engaged with unlicensed gambling sites during 2024.

For governments across the European Union, the numbers represent more than lost revenue. Gaming taxes in many jurisdictions fund essential services such as healthcare, education, and responsible gambling programs. A €20 billion shortfall means diminished resources at a time when budgets are already strained.

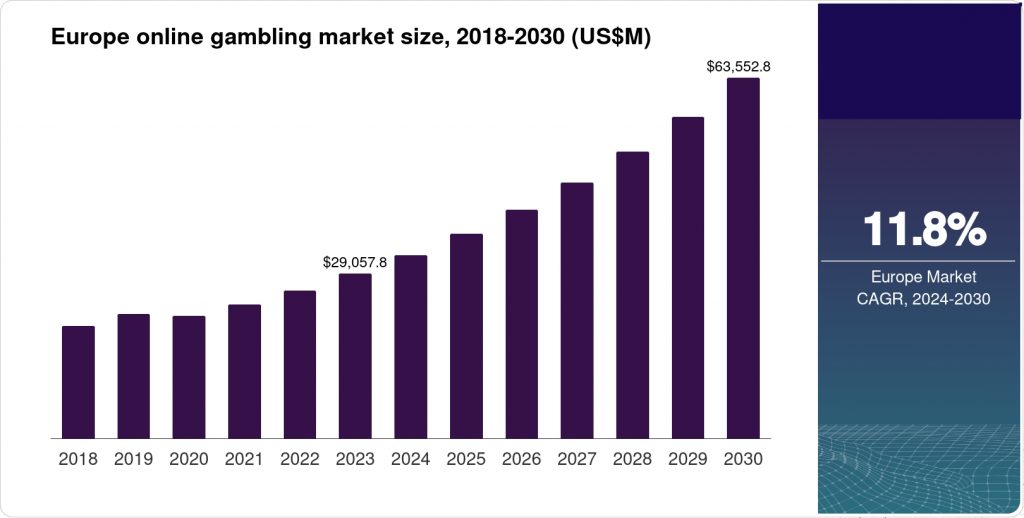

The ECA estimates that shifting 20% of illegal gambling revenue to regulated markets could yield an additional €4 billion in tax revenue annually by 2030. Licensed operators are also pushing for fair access to banking services to strengthen the industry's financial infrastructure.

Licensed operators, meanwhile, are left to compete on uneven ground. Black-market sites frequently ignore anti-money laundering controls, avoid player-protection standards, and market aggressively with bonuses and promotions that regulated companies cannot legally match. Analysts warn that this creates a dual risk: consumers are exposed to unsafe platforms, and regulated companies lose legitimacy in the eyes of players.

The European Casino Association emphasized the urgency of coordinated regulatory action. “The black market is no longer operating on the margins,” one ECA spokesperson told : “It has captured a majority share of Europe’s online gaming economy, and governments must act quickly to restore balance.”

Policy experts suggest that solutions may include tighter advertising oversight, stricter payment-blocking mechanisms, and more cross-border cooperation between national regulators. Without such measures, the regulated industry risks further erosion — with long-term consequences not only for casinos and sportsbooks, but also for public finances and consumer trust.