Luxury, hospitality, and real estate fuel Société des Bains de Mer’s success

Monte-Carlo’s famed Société des Bains de Mer (SBM) reported a 6% increase in consolidated revenue for the third quarter of the 2024/2025 financial year, despite a decline in gaming revenue. The rise was driven by booming hotel and real estate sectors, reinforcing Monte-Carlo’s position as a global luxury destination.

Gaming struggles while hospitality and real estate thrive

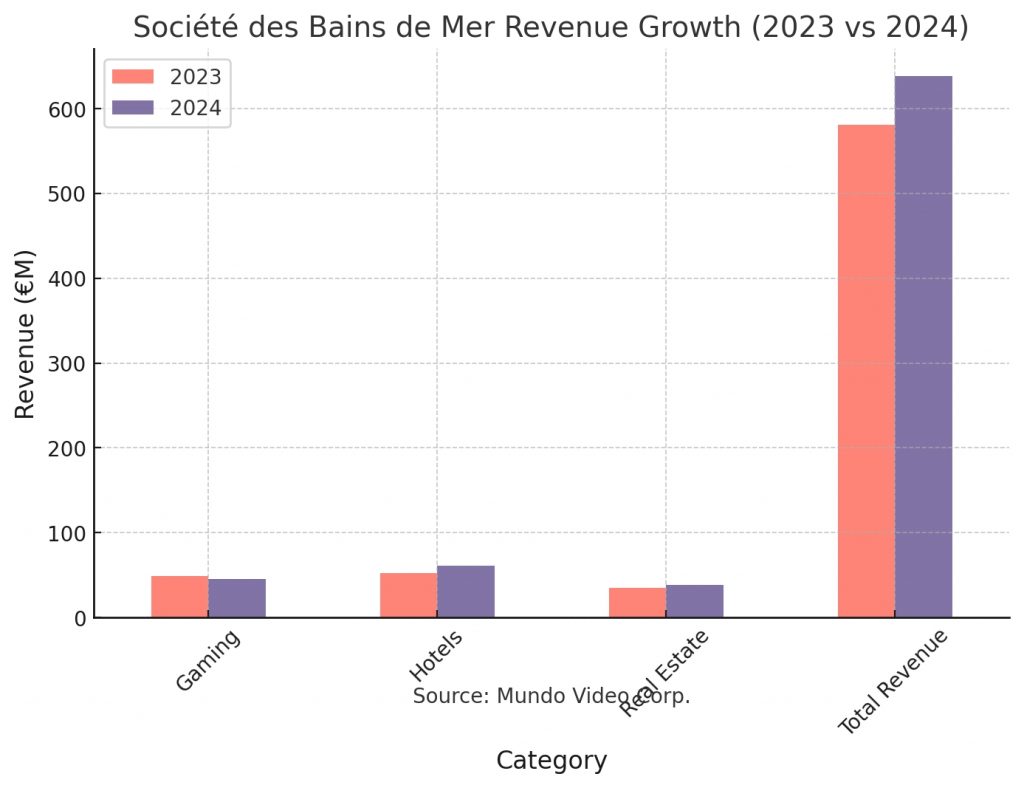

SBM’s gaming revenue dropped to €45.2 million, down €3.4 million from the previous year, due to stricter compliance measures and a less favorable risk environment. However, the automatic gaming sector saw notable growth.

Meanwhile, the hospitality sector surged 18% to €61.1 million, benefiting from increased occupancy rates and premium pricing, particularly during the festive season. New openings, including Amazónico Monte-Carlo and the renovated Café de Paris Monte-Carlo, further boosted earnings.

SBM’s revenue growth in key sectors

To illustrate SBM’s performance across different sectors, here is a visual breakdown comparing revenue in 2023 and 2024:

The real estate sector also experienced a €2.9 million revenue increase, reaching €38 million. This was fueled by high-end commercial rentals and strong occupancy rates, particularly at the Café de Paris complex.

Monte-Carlo: a global gambling hub in transition

Monte-Carlo has long been synonymous with high-stakes gambling and luxury tourism. However, tightened regulations and a shift toward diversified luxury experiences are reshaping its revenue streams. SBM’s €638.6 million revenue over the first nine months of 2024/2025 reflects a 10% year-on-year growth, a trend expected to continue.