Lisbon, Portugal — In September 2025, the Portuguese government is actively assessing bidders for casino concessions in Espinho, Póvoa de Varzim, and the Algarve region. These concessions cover five casinos and are expected to generate approximately 100 million euros annually in licensing revenue over the next 15 years. Officials have warned that any postponement in the tender process risks derailing the tightly scheduled award timeline, reinforcing their commitment to adhere strictly to deadlines despite challenges during bid submissions.

Officials from the Portuguese tourism institute highlighted the process’s urgency and importance. One senior official stressed, “Delaying the concession tender is a risk we cannot afford,” emphasizing how adherence to regulatory timetables is crucial to maintaining market confidence and supporting long-term economic planning within Portugal’s gaming sector.

Portugal opens casino license race as september deadline nears for five regional concessions

Portugal has officially launched a competitive public tender for five casino concessions across key gaming zones, as part of its long-anticipated land-based market renewal. The process was formally published on July 24, 2025, and the deadline for proposals is set for September 5, 2025.

The available concessions cover three licenses in the Algarve, one in Espinho, and one in Póvoa de Varzim, all replacing expiring contracts. Each license includes a 15-year term, extendable by five years.

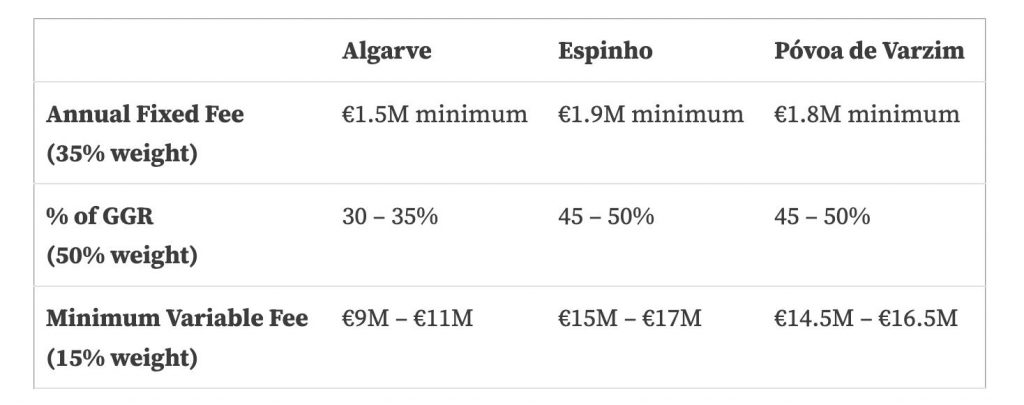

Applicants must meet operational, financial, and regulatory standards. Licenses will be awarded based on a scoring system with three weighted criteria:

- Annual Fixed Fee (35% weight)

- Algarve: €1.5M minimum

- Espinho: €1.9M minimum

- Póvoa de Varzim: €1.8M minimum

- Share of Gross Gaming Revenue – GGR (50% weight)

- Algarve: 30% – 35%

- Espinho: 45% – 50%

- Póvoa de Varzim: 45% – 50%

- Minimum Variable Fee (15% weight)

- Algarve: €9M – €11M

- Espinho: €15M – €17M

- Póvoa de Varzim: €14.5M – €16.5M

The Barlavento zone in Western Algarve is the only area where operators must develop their own infrastructure. In all other zones, premises and equipment are available.

Legal advisors describe this as a rare market entry window, especially as no additional concessions are expected before 2032, when the Madeira license expires. Incumbent operators such as Estoril Sol SGPS are expected to re-bid for current zones. Meanwhile, international interest is growing, particularly for the Algarve region due to its tourism footprint. Portugal’s Ministry of Finance expects this process to attract high-quality bidders aligned with the country’s fiscal, regulatory, and regional development goals.