Spain’s government is attempting to reinstate sweeping gambling advertising restrictions—previously annulled by its Supreme Court—by embedding them into the unrelated Customer Service Reform Bill. This legislative maneuver, led by ruling coalition parties PSOE and SUMAR, has raised legal and ethical concerns across the gaming industry and European compliance circles.

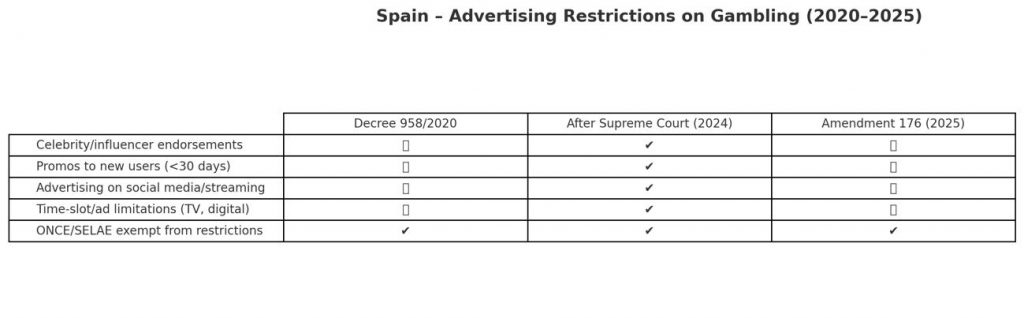

The original Royal Decree 958/2020, which imposed some of Europe’s strictest advertising bans on gambling operators, was overturned in 2024 after the Supreme Court ruled key parts unconstitutional. The court highlighted that the decree lacked sufficient legislative basis and violated regulatory proportionality.

Spain levels up regulation: New bill targets loot boxes to protect minors online

Now, through Amendment 176 to the Customer Service Bill, the Spanish Parliament seeks to revise Law 13/2011 on Gambling, effectively reintroducing the same restrictions through legislative back channels.

Key provisions under Amendment 176 include:

- Banning gambling ads involving celebrities or influencers.

- Prohibiting promotional campaigns to users with accounts less than 30 days old.

- Restricting advertising on digital platforms, streaming services, and social media.

- Reinstating time-slot and content limitations on audiovisual advertising.

Notably, public lotteries like ONCE and SELAE remain exempt from many of these restrictions, a point heavily criticized by private operators for creating an uneven playing field.

Spain has everything ready to change gambling regulations

Critics argue that the government failed to notify the European Commission under Directive 2015/1535, which requires advance disclosure of technical regulations affecting service provision within the EU. This oversight could open the door to fresh legal challenges and even EU infringement proceedings.

Spain’s DGOJ Invests in AI Surveillance and Technical Audits to Tighten Online Gambling Oversight

The proposed amendments come despite Spain reporting a decline in gambling-related harm, with the 2024 national prevalence study showing problem gambling rates at 1.4%, down from 2.6% in 2018. Industry stakeholders argue that public health data does not justify reintroducing such expansive restrictions.

If passed, the reform risks setting a precedent for policy laundering—using unrelated legislative channels to reinstate previously nullified rules. For operators, media agencies, and EU observers, the move highlights ongoing legal uncertainty in one of Europe’s most complex gambling markets.