Star Entertainment Group, a prominent Australian casino operator, is grappling with severe financial distress, prompting significant asset divestitures in a bid to stave off collapse. The company's recent decision to sell its Sydney Event Centre to Foundation Theatres for A$60 million is a strategic move to bolster its liquidity amid escalating challenges.

Over the past two years, Star has faced a series of scandals and regulatory penalties that have severely impacted its financial standing. In 2022, the New South Wales Independent Casino Commission imposed a record A$100 million fine on the company for failing to prevent money laundering activities at its Sydney casino.

This was followed by an additional A$15 million fine in 2024 due to ongoing compliance issues.

The financial repercussions of these penalties have been compounded by declining revenues, particularly from Star's Sydney and Gold Coast casinos, which have been adversely affected by the implementation of cashless gaming regulations. Additionally, the company's ambitious Queen's Wharf development in Brisbane has become a significant financial burden, contributing to its mounting debt.

In response to these challenges, Star has initiated a series of asset sales to improve its financial position. Notably, the company sold the leasehold of Brisbane’s Treasury Casino building to Griffith University for A$67.5 million and is considering the sale of hotel properties in Sydney and on the Gold Coast.

Despite these efforts, the company's future remains uncertain. The NSW Independent Casino Commission has indicated that it may cancel Star's casino license or impose further financial penalties if compliance issues are not adequately addressed.

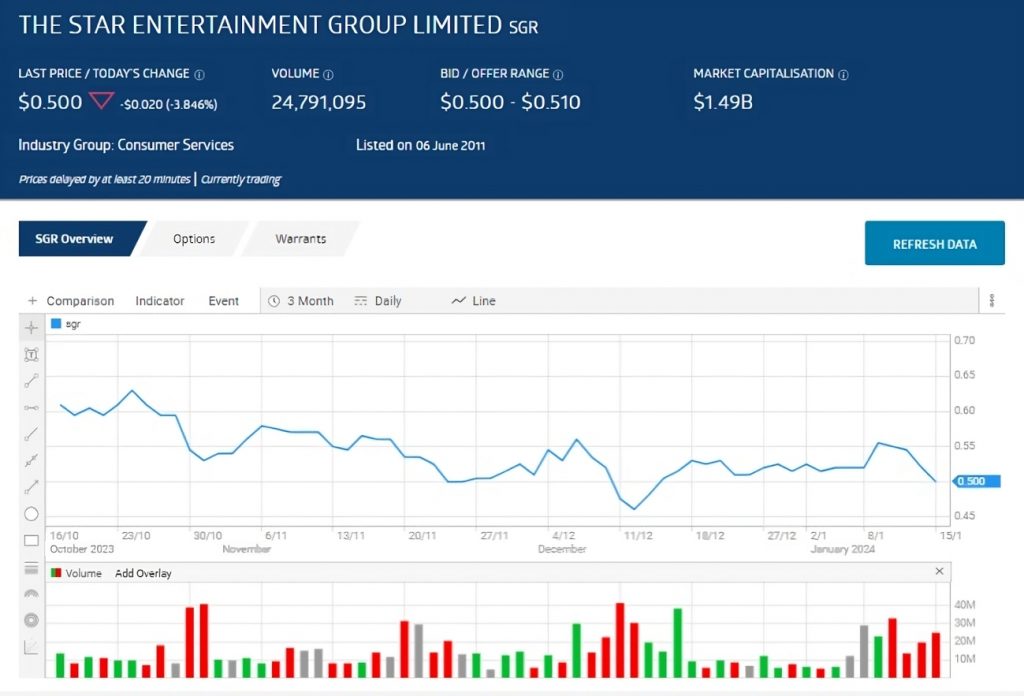

Moreover, the company's financial instability has led to a significant decline in its share price, reflecting eroding investor confidence.

As Star Entertainment Group navigates this tumultuous period, its ability to implement effective remediation measures and restore regulatory compliance will be critical to its survival. The company's ongoing asset sales and efforts to restructure its operations underscore the severity of its current predicament and the challenges it faces in regaining stability.