London, united kingdom – On September 10, 2025, the British horse racing industry staged a historic one-day strike, suspending all events at major venues including Carlisle, Uttoxeter, Lingfield, and Kempton.

The protest responds to a government proposal to increase and unify betting duties from 15% to 21%, equating horse racing and sports betting taxes with those imposed on online casino games. This unprecedented collective action highlights the sector’s urgent concerns over the tax impact.

Punters fuming as UkK horse racing grinds to a halt over tax row

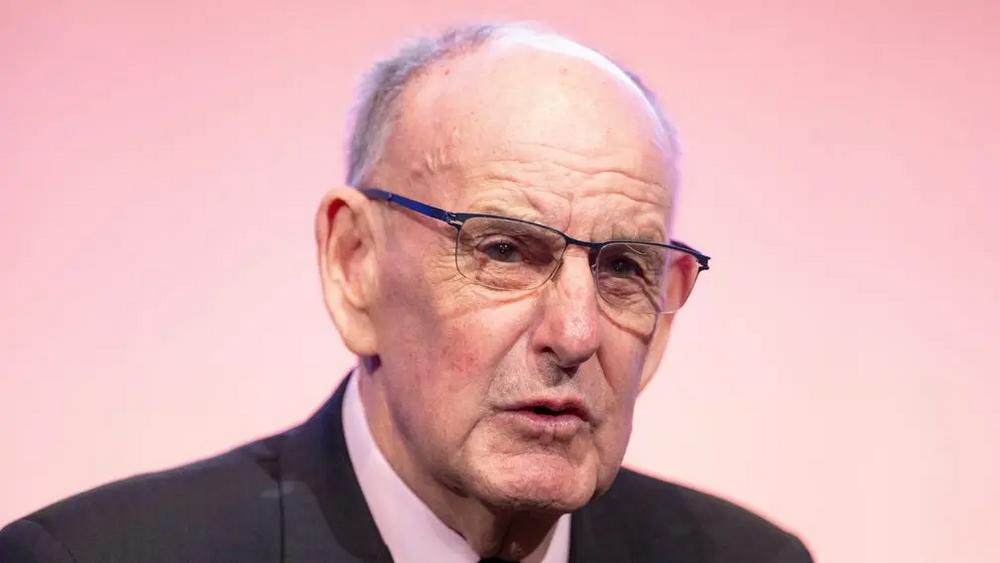

BHA chairman Charles Allen voiced serious alarm about the proposed rise, stating, “We need every part of our industry — trainers, jockeys, stable staff, racecourses, and fans — to stand together and make their voices heard.” He stressed horse racing’s significant role in the UK economy, supporting approximately 85,000 jobs and generating more than £4 billion annually. Allen warned that the tax increase would threaten the sport’s funding model and the livelihoods it sustains.

The legal framework focuses on adjustments to the online gambling tax structure, aiming to consolidate the tri-tier system into a single rate. The government plans to raise betting duties to align with those for games of chance, as outlined in consultation documents and pending budget discussions scheduled for November 26, 2025. The British Horseracing Authority’s “Axe the Racing Tax” campaign estimates a loss of at least £66 million annually, endangering thousands of jobs tied to the industry.

Economically, the proposed hike risks undermining the horse racing sector’s viability, with detrimental effects on related communities and businesses. The Betting and Gaming Council warns that higher taxes may push betting activity offshore to unregulated markets, complicating compliance and consumer protection efforts. Proponents argue the tax alignment is essential to simplify regulations and promote fiscal fairness across gambling sectors.

As the industry confronts this challenge, the tax proposal stands at a crossroads — will it endure as a fiscal safeguard, or will sector resilience and political negotiation reshape its future?