France's gaming regulator, known by its French acronym ANJ, is set to prohibit access to Polymarket, a cryptocurrency-based betting platform, within the country. This decision follows a report from The Big Whale, a French publication focused on the crypto industry, which cites an unnamed source close to the ANJ.

What is Polymarket, and why did it catch the attention of ANJ?

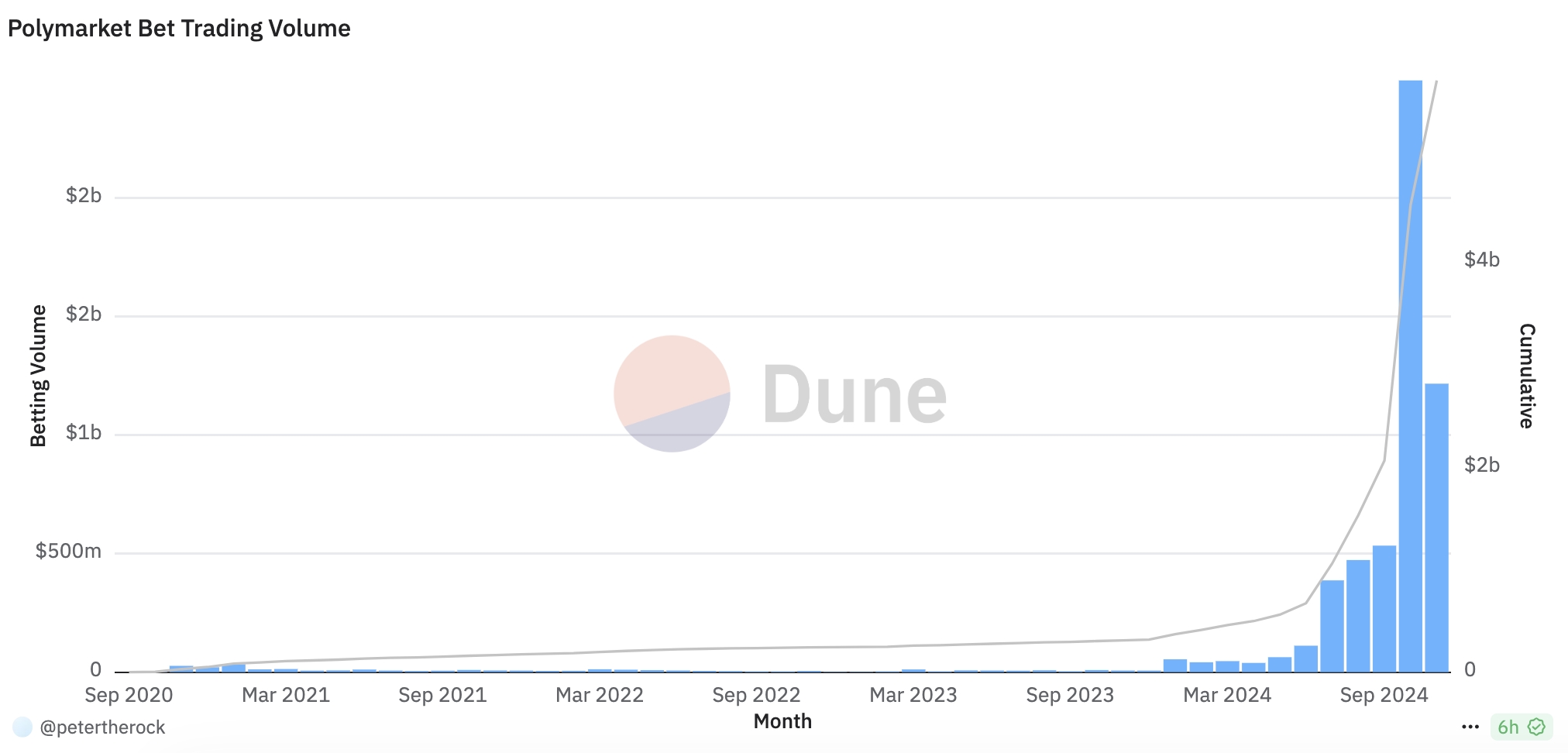

Launched in 2020, Polymarket is a decentralized prediction market platform that allows users to bet on real-world event outcomes using cryptocurrencies. The betting platform has seen huge success in 2024 amid the US election hype, reaching $2.5 billion in bets in October, according to data from Dune Analytics.

Polymarket bet trading volume. Source: Dune Analytics

Although Polymarket is headquartered in New York, the platform is currently inaccessible to US residents. However, people in other parts of the world, like France, have been using it actively.

For example, a pseudonymous trader and an alleged French national placed at least $20 million worth of bets supporting Donald Trump as the next US president. Nicknamed Fredi9999, the Polymarket user is expected to see nearly $50 million in profits across four identified accounts, according to Bloomberg.

ANJ targets sports sponsorship cuts in consumer protection drive

The source described Polymarket as a "betting activity," which is deemed illegal under French law. The ANJ is currently reviewing Polymarket's operations to assess its compliance with French gambling regulations. Neither the ANJ nor Polymarket responded to DLNews' requests for comment, and it remains unclear if The Big Whale sought a statement from Polymarket.

Polymarket gained significant attention during the US presidential election, with traders placing multimillion-dollar bets on the outcome. By election day, the platform had reached a cumulative volume of $3.5 billion, according to Dune Analytics. Despite skepticism from financial experts regarding its predictive accuracy, Polymarket's forecasts were validated when President Joe Biden withdrew from the reelection race and Donald Trump secured a victory, outcomes that the platform had suggested were likely based on user bets.

The platform has also attracted scrutiny from US regulators. In May, the Commodity Futures Trading Commission (CFTC) proposed a rule targeting prediction markets, also known as event contracts, citing concerns over potential manipulation and the creation of perverse incentives.

The public comment period for this proposed rule concluded in August, but it remains uncertain whether the Securities and Exchange Commission (SEC) will implement a similar regulation.

Polymarket's activities caught the attention of French regulators partly due to a prominent user, a French trader known as Theo, who placed substantial bets on a Trump victory. This led to speculation about potential market manipulation, although Theo clarified in an interview with The Wall Street Journal that his bets were based on his belief in Trump's likelihood of winning.

His wager resulted in a $49 million payout after the election results were announced. The situation highlights the ongoing regulatory challenges faced by cryptocurrency-based platforms in navigating international gambling laws.