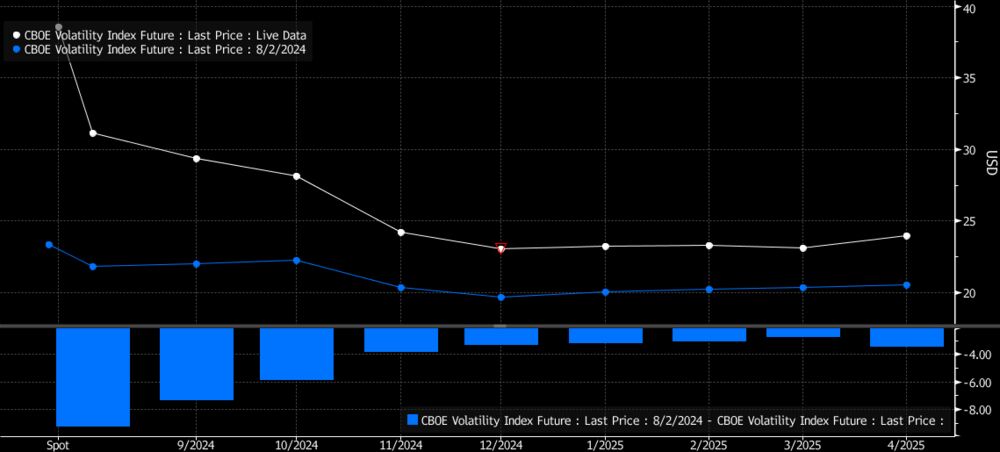

The world was rocked by considerable drops to stock markets on Monday after news of a possible slowing economy in the U.S. The S&P 500 dropped 3% on Monday, the largest one-day fall since 2022, and the Dow Jones Industrial Average dipped 2.6%, or 1,034 points.

The selloff began earlier on Monday in Asia, as the Japanese stock index fell 12.4% — the biggest loss since the 1987 stock market crash in the U.S. Like many companies, gaming stocks didn’t fare well during Monday’s storm.

For example, Caesars Entertainment saw a tumble in stock price of almost 7%. The company is fresh off announcing a $500 million sale of the World Series of Poker. MGM Resorts lost almost 4% of its value as well.

Bally’s Corporation avoided some of the damage, dropping only 0.08%, and is currently considering a potential buyout offer from one its largest shareholders.

Flutter Entertainment, the Ireland-based gaming company behind brands like FanDuel, PokerStars, and SkyBet, dropped almost 6% on Monday as well, while DraftKings was less impacted with a drop of just 0.22%.

Entain, which owns PartyPoker, Ladbrokes, bwin, and is a partner in the BetMGM platform in the U.S., was down more than 4%. Online gaming and sports betting operator Rush Street Interactive shed over 6.4% of its value.

Meanwhile, Las Vegas Sands was down 0.53%, Boyd Gaming was down 2.04%, and Wynn Resorts was down 4.23%.

After Monday’s results, Dow futures were up Tuesday morning and Japan’s Nikkei increased 10%. Some financial experts indicated a recession wasn’t necessarily looming despite recent reports of rising unemployment and inflation remaining a problem for many Americans. However, some bumpiness in the stock market could continue, according to some financial experts.

“Monday’s market rout increases both the risks of recession and a more harrowing financial-market accident,” Nick Timiraos noted in the Wall Street Journal. “But for Federal Reserve officials who laid the groundwork last week to cut rates by a quarter-percentage point at their meeting next month, the outlook would likely need to deteriorate further in the coming weeks to compel a bigger response.”

By mid-morning on Tuesday, the Dow was back up over 1%, more than 400 points.