Bogotá, Colombia - Colombia has enacted a Value Added Tax (VAT) on online sports betting, a move designed to create a fairer competitive landscape in the gambling sector. While digital betting companies have raised concerns about increased tax burdens, government officials argue that the measure is necessary to establish a level playing field and ensure greater transparency.

Historically, brick-and-mortar gambling venues such as casinos and bingo halls have been subject to high tax rates and strict regulations, whereas online betting platforms have operated under more lenient fiscal policies. This has given digital operators a competitive edge, allowing them to expand rapidly and gain market dominance, often to the detriment of traditional gaming establishments. Bingo halls, a staple of Colombian culture, have been particularly affected by this shift.

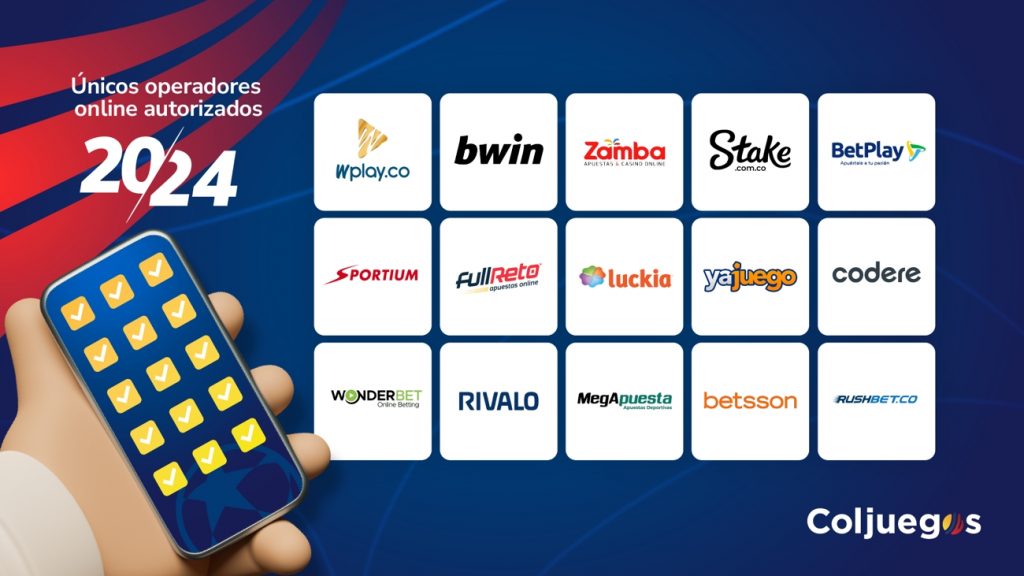

The newly imposed VAT aims to rectify these imbalances by ensuring that all operators contribute fairly to public finances. Coljuegos, Colombia’s gambling regulatory authority, expects the new tax to significantly boost revenue, with much of it allocated to essential public services such as healthcare and education.

Another critical aspect of this policy is its push for financial transparency among gaming companies. Online operators have long claimed that nearly all player wagers—about 98%—are returned as winnings. However, Coljuegos’ data presents a different picture, indicating that online betting platforms typically maintain a Return to Player (RTP) rate between 82% and 85%, whereas land-based casinos and bingo halls offer RTPs of at least 95%. These discrepancies highlight the impact of differing regulatory environments on consumer outcomes and market sustainability.

Online betting companies, through associations such as Fecoljuegos, are lobbying for the government to reconsider or revoke the VAT. However, financial data and RTP figures demonstrate the significant fiscal space for taxation in this sector. The necessity of increased public revenue and the disparities in regulatory conditions further justify the application of these taxes.

By introducing VAT for all gaming operators, Colombia aims to foster a more equitable market and increase state revenue. In 2024 alone, gambling activities generated over 1.5 trillion pesos ($380 million) in industry contributions. Authorities expect these figures to rise further under the revised tax scheme.

Land-based gambling businesses view this initiative as a long-overdue reform that acknowledges their economic contributions and provides a fairer competitive environment. While online operators remain resistant to higher tax obligations, the VAT introduction is positioned as a crucial step toward the long-term sustainability and credibility of the gaming sector.

Moving forward, it will be essential for regulatory agencies to oversee the efficient allocation of VAT revenue, ensuring that the additional funds benefit public services and reinforce the gambling industry’s role in national development.