The Singaporean government said on April 3 that it had agreed to the expansion of the city-state’s two integrated casino resorts. In return for their investment, an aggregate of US$6.65 billion, the respective operators would continue to hold a duopoly on casino gambling in Singapore through 2030, it added at the time.

However, the new tower to be built in Singapore by U.S.-based casino operator Las Vegas Sands Corp as part of the expansion plans for the firm’s Marina Bay Sands complex (pictured), will not include gambling place as has been said before.

As part of the agreement with the Singaporean government, casino resort Marina Bay Sands will build a fourth tower adjacent to its existing complex. The project includes a 15,000-seat arena and a new luxury all-suite hotel with approximately 1,000 rooms, topped with a sky roof. The agreement additionally allows Marina Bay Sands to increase its total gambling floor area by 13.3% to a limit of 17,000 square metres for a total of 183,000 sq feet.

I loved

I liked

I dont liked

The show MGM 2049 will debut at MGM Cotai’s MGM Theater in December, described as a “grand tribute” to the 75th anniversary of the founding of the People’s Republic of China and the 25th anniversary of Macau’s return to the Motherland.

However, MGM said the show also aims to act as a catalyst to propel the city’s cultural and entertainment sectors towards new heights. Although residency shows have been few and far between in Macau over the years – a few notable exceptions aside – the Macau SAR Government has outlined its desire to transform Macau into a “City of Performing Arts” as part of its economic diversification initiatives. This, the government has explained, will establish a center of cultural tourism within the Greater Bay Area (GBA) while promoting Chinese culture to the world.

The company is offering over 200 positions for global candidates with on-the-job training opportunities covering several areas, including actors, dancers, art directors, cast managers, performance managers, theater technicians and more.

In preparation for the show, MGM hosted in April the “MGM 2049: Symposium and Global Recruitment Program Kick-off Ceremony” where Zhang and the show’s global creative team came together in Macau to share insights into the residency show’s concept. MGM also kicked off its “Global Recruitment Program”, which offers various job opportunities to aspiring young people interested in pursuing a career in performing arts.

Organized by Global Poker Index Asia and CTP Club, GPI Asia Poker Festival is set to make a triumphant return in Taipei City, Taiwan with ten days of games taking place at the Asia Poker Arena.

Now in its third installment, the annual event takes place from May 17 to 26, 2024. With poker in the country growing in leaps and bounds, larger returns have been promised highlighted by a guaranteed prize pool exceeding 5 Million New Taiwan Dollars (~USD 153,700). Raymond Wong from GPI Asia expressed.

GPI Asia Póker Festival

The Global Poker League kicks off the festivities. It is the most exciting Teams Event introduced in Asia featuring a NTD $300,000 (~USD $9,200) guarantee. Now in its seventh edition, the three-day event will see teams compete in various formats and in two variants – No Limit Hold’em and Pot Limit Omaha. Buy in is NTD $20,000 (~USD $615) per team.

Each team is made up of four players – 1 captain and 3 players. In addition to the cash prize, the winning team will receive THM Championship Taiwan seats worth NTD $7,000 per member.

HSBC Global Research predicts that MGM China, Wynn Macau, Galaxy, and Sands China will pay dividends in 2024, while Melco and SJM are likely to withhold dividends.

In a recent report on HSBC Global Investment Summit 2024 key takeaways, the financial services agency said that Macau’s gaming demand remains healthy, while gaming operators “remain committed to shareholder returns”. Analysts Charlene Liu, Jessie Lu, and Lauren Cai maintain a ‘buy’ rating for MGM China and Galaxy, noting that both operators observed positive trends across all business segments, with notable upticks in VIP segment.

In a recent report on HSBC Global Investment Summit 2024 key takeaways, the financial services agency said that Macau’s gaming demand remains healthy, while gaming operators “remain committed to shareholder returns”. Analysts Charlene Liu, Jessie Lu, and Lauren Cai maintain a ‘buy’ rating for MGM China and Galaxy, noting that both operators observed positive trends across all business segments, with notable upticks in VIP segment.

Macau gaming stocks remain intact, supported by a steady daily gross gaming revenue.

Earlier in March, MGM China announced a final dividend of HKD0.243 per share and a special dividend of HKD0.104 per share for 2023. Similarly, Wynn Macau declared a final dividend of HKD0.075 per share for the same fiscal year.

“With growing offerings of non-gaming events of a different nature, both[operators] expect to see travelers return more often to Macau and the seasonality trend to smoothen out,” the analysts said.

Thailand’s Ministry of Finance has been appointed lead agency to consider a House committee study recommending the legalization of casino gaming but will work with 16 other agencies in doing so, local media reports.

Deputy Finance Minister Julapun Amornvivat, who chairs the House committee, said earlier that the complexes would create jobs, boost tourism, and curb illegal gambling. He expected the complexes to generate 40-50 billion baht of revenue annually. After the plan is greenlighted, a policy-level committee will be established to supervise the project, to be chaired by the Prime Minister, he said.

Thailand’s National Assembly to debate introducing casinos on March 28

An administration-level committee will then be formed, comprised of ministers and executives from related agencies to consider each aspect of the project in detail.

The 16 other agencies named include the ministries of Tourism and Sports, Social Development and Human Security, Higher Education Science Research and Innovation, Agriculture and Cooperatives, Transport, Interior, Justice, Labour, Culture, Education, Public Health and Industry.

The study itself recommends imposing a 17% tax on gross gaming revenue – making it one of the lowest tax regimes in the region – with locals to be required to pay an entry levy of an amount yet to be determined. License duration would be set at an initial 20 years and then renewable every five years, while the larger casino complexes would require a minimum investment of US$2.7 billion.

The Office of the Council of State, the National Economic and Social Development Council, the National Office of Buddhism and the Royal Thai Police will also be consulted.

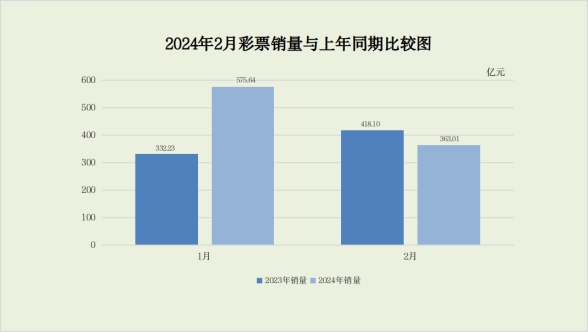

In march, a total of 36.301 billion yuan of lottery tickets were sold nationwide, a year-on-year decrease of 5.509 billion yuan or 13.2%. Among them, the sales of welfare lottery institutions were 12.632 billion yuan, a year-on-year decrease of 899 million yuan, a decrease of 6.6%; the sales of sports lottery institutions were 23.669 billion yuan, a year-on-year decrease of 4.610 billion yuan, a decrease of 16.3%. This is mainly because the market was closed during the Spring Festival holiday in February this year.

Cumulatively from January to February, a total of 93.865 billion yuan in lottery tickets were sold nationwide, an increase of 18.832 billion yuan or 25.1% year-on-year.

Among them, the sales of welfare lottery institutions were 32.322 billion yuan, an increase of 7.950 billion yuan or 32.6% year-on-year; the sales of sports lottery institutions were 61.543 billion yuan, an increase of 10.882 billion yuan or 21.5% year-on-year.